Days after reporting strong second-quarter results, Palantir Technologies (NYSE: PLTR) gave investors even more good news when it announced an expanded partnership with Microsoft (NASDAQ: MSFT). The aim is to sell analytic and artificial-intelligence (AI) services to various defense and intelligence agencies within the federal government.

Palantir built its reputation helping U.S. government intelligence agencies track and fight terrorism through its data gathering and analytics platform, but the government has actually become one of the weak spots for the company over the past couple of years. Let’s look at how this deal could change that.

Looking to boost federal government sales

The U.S. government has long been Palantir’s largest customer, although its growth has become a weak spot for the company. Total government revenue growth, including foreign governments, slowed to 19% in 2022 and only 14% in 2023.

It has seen a bit of a rebound this year, with total government revenue growth of 23% year over year to $371 million in the second quarter and U.S. government growth of 24% to $278 million.

However, that still trailed its faster-growing commercial segment, which saw a year-over-year increase of 33% to $307 million in the quarter. Commercial revenue in the U.S., in particular, grew even faster at 55% to $159 million.

This partnership with Microsoft will look to kick start growth in its U.S. government segment. Palantir’s entire suite of products will be now be able to be deployed using Microsoft’s government cloud, including Microsoft Azure Government, Azure Government Secret, and Azure Top Secret cloud. The partnership will also use Azure’s OpenAI Service and integrate its large language models, including GPT-4, into Palantir’s Foundry software and its Artificial Intelligence Platform (AIP).

One of the big goals of the partnership will be to help speed up deployments, especially with AIP. In combination with Microsoft, the company will run boot camps to let the defense and intelligence community test the technology.

Palantir has been very successful in driving new customer acquisitions with its boot camps in the commercial sector, and it will look to take that to the federal sector as well. These workshops provide training and demonstrate how AIP can be applied to mission-critical operations and other potential uses.

One downside to Palantir’s government business is that it can be contract work for specific projects. If the company can begin integrating AIP into more government workloads, it can help create a longer-lasting, more reliably recurring revenue stream. Providing AI services to various government defense and intelligence agencies is a huge opportunity for the company, and the Microsoft partnership should make getting approvals easier.

Is the stock a buy?

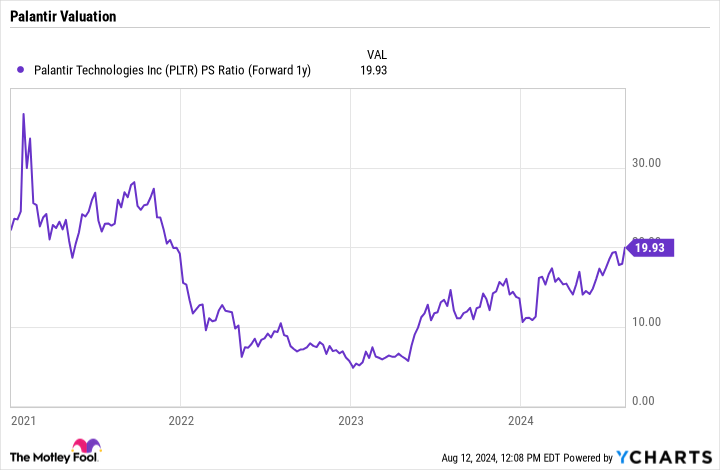

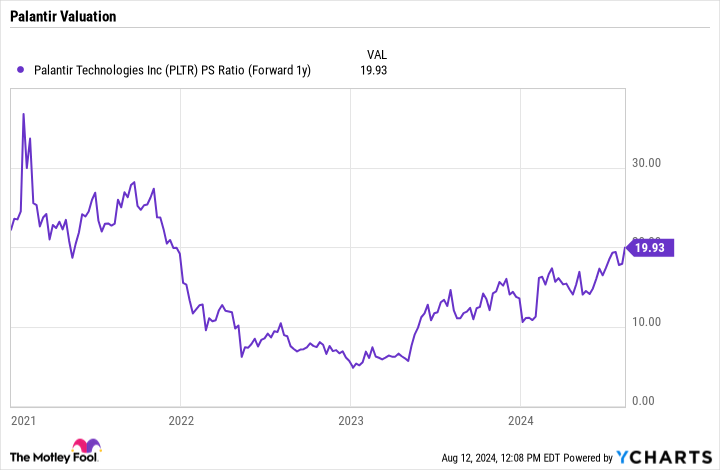

Palantir has proved the strength of its technology, but the one thing that keeps many investors cautious is its valuation. The stock trades at a forward price-to-sales ratio (P/S) of about 20 times based on 2025 analyst estimates.

For a company growing revenue by under 30%, that is quite an expensive multiple. To justify that, it would need to accelerate it beyond 30%. Palantir has begun to see a rebound in its U.S. government business, and this new partnership could reinvigorate that even more. But based on its current valuation, it appears the market is already pricing that happening into the stock.

I think Palantir has a good long-term opportunity, but given its valuation, I would rather be a buyer on a pullback. Even the best tech companies go through periods when their stock prices fall, and I’d prefer to be patient and not chase the shares at these valuations.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Will a New Microsoft Partnership Help Launch Palantir’s Stock to the Moon? was originally published by The Motley Fool