Skift Take

Think quiet quitting is just for employees? Think again. In 2024, many of the world’s biggest airlines are making a low-key withdrawal from China. We find out why.

Finnair Flight 101 was routine, but everything was about to change. Departing Helsinki just after 5 pm on February 22, 2022, the nonstop service to Hong Kong flew uneventfully through the night, landing shortly before 9 am the following morning.

Within days, this well-trodden flight path – and dozens like it – would be upended beyond recognition as Russia launched its invasion of Ukraine. By February 28, Russia closed its airspace to most Western airlines. This didnât just affect flights serving Russian cities â it shut off a critically important air corridor linking Europe and the Far East.

With Russian airspace closed, a long and costly detour was unavoidable for European carriers. Flight planners developed new routes circumventing Russia and Ukraine while dodging other geopolitical hotspots â no mean feat when the Middle East is involved.

Fuel typically accounts for around 25% of an airlineâs operating costs and the longer journeys tipped marginally profitable Euro-China routes into red-ink territory. Some that were due to resume after the pandemic were suspended indefinitely.

Skift analysis of Cirium Diio data shows that in August 2019, Finnair operated 42 nonstop flights a week from Helsinki to China. By August 2024, Finnair was operating just three, with a further daily service to Hong Kong. The total number of available seats to the country each week had shriveled from more than 12,800 to less than 2,800. Take Hong Kong out of the mix and it was just over 800.

China is something of an anomaly among Finnairâs Far Eastern links. Its network to Japan has bounced back with four destinations served by August 2024. Seoul, Bangkok, and Singapore have all resumed their pre-pandemic frequency, with a net increase in flights to Phuket this winter. All of these routes previously relied on Russian airspace and are surviving – if not thriving. So whatâs behind this plummet in capacity to China?

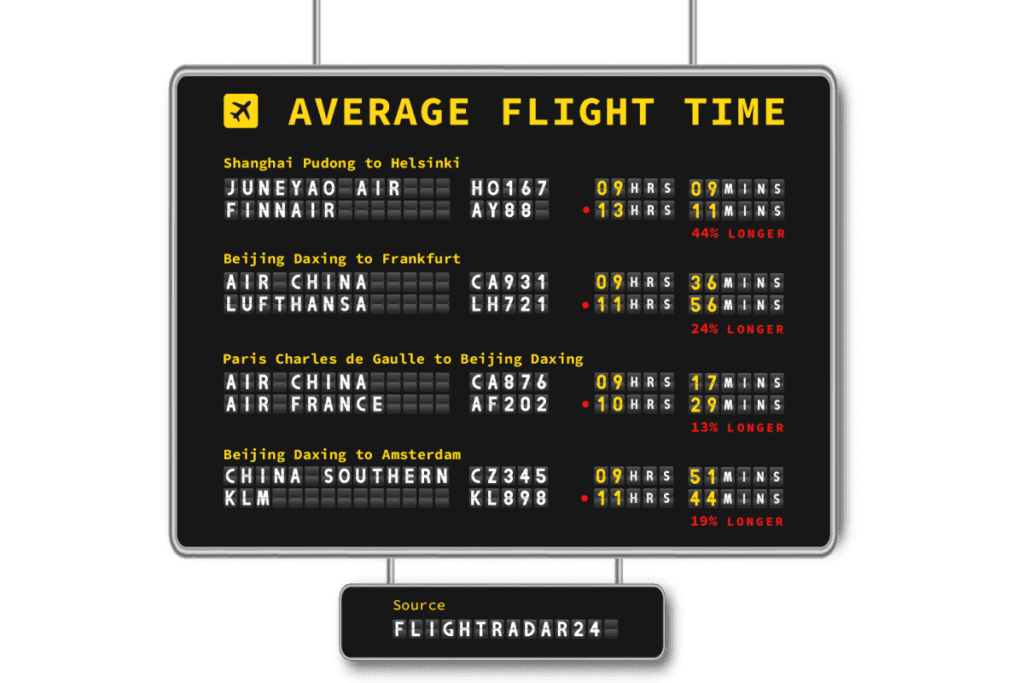

Skift analyzed data from Flightradar24 for Finnairâs Helsinki to Shanghai service â the only mainland route the company is currently operating. The pre-war flight time was around eight hours and 30 minutes. The average in August and September 2024 was 11 hours and 24 minutes.

Chinese airlines are unaffected by Moscowâs airspace ban, and Chinaâs Juneyao Air continues to serve the Finnish capital with pre-war journey times. An additional three hours in the sky is a tough sell for the Helsinki-based firm. Itâs even harder for a company that prides itself on being a sustainability pioneer.

Speaking to Skift, Christine Rovelli, Finnairâs Chief Revenue Officer contextualized the challenges facing the airline. âDue to the closure of Russian airspace, flight times to our Asian destinations have increased by between 10 and 40 percent, depending on the destination. We have successfully adapted to this situation and refocused our network, with more emphasis on westbound flying while maintaining a strong presence in our key Asian markets.

âWith respect to Greater China, although we maintain daily service to Hong Kong, we currently only fly three weekly flights to Shanghai, and will have two weekly frequencies in the upcoming winter season. We continue to evaluate the market situation closely and optimize our network and schedules accordingly,â added Rovelli.

How Are Airlines Quiet Quitting?

It’s tempting to write this off as an unfortunate situation unique to Finnair. After all, the Nordic country shares an 800-mile border with Russia and its flag carrier has been hit harder than most. The reality is that Finnair is far from alone.

Carriers across Europe are actively cutting capacity to China; theyâre just not shouting about it. Airline marketing departments go into overdrive when announcing a new route. Ribbon-cutting, fare promotions, and novelty cakes. However, thereâs no call to the bakery when a city is discreetly dropped from the network. Companies are quieter still when maintaining a destination, but reducing the number of flights it operates.

The concept of quiet quitting rose to prominence in the summer of 2022, but it was about burnt-out employees. Itâs widely attributed to TikTok user Zaid Khan whose celebration of slow withdrawal resonated with a jaded workforce. This isnât about marching into the bossâ office with a fiery resignation letter, rather itâs a way to remain employed, but doing a lot less.

And, if you go by the ever-thinning schedules, this is essentially what large chunks of the airline industry are doing with China.

A carrier can still serve the country, but it may lower the operating frequency and/or reduce the size of the aircraft. These changes can be the difference between a profit or loss for network planners. The airline also saves face and retains the dot on the route map while reducing its exposure to a soft market. Why battle for profitability on the Beijing route when that same plane and crew could be deployed to Boston for a much greater return on investment?

The list of airlines that fall into this quiet quitting category is already large, and itâs growing by the week. In August, British Airways announced it would suspend its London Heathrow to Beijing service, after regular flights there since 1980. The route is off the schedule until at least November 2025.

At the time of the Beijing announcement, BA stressed that it will continue to serve Shanghai and Hong Kong. But from the end of October, its Heathrow to Hong Kong service will drop from twice daily to once a day. It will also be operated by a Boeing 787-9 with 216 seats; a far cry from the âsuper jumboâ Airbus A380 with 469 seats that once plied on the route.

In late September, German flag carrier Lufthansa confirmed to Skift that it was âreviewing the continuationâ of its daily service from Frankfurt to Beijing. A spokesperson acknowledged that âit is becoming increasingly challenging for Lufthansa Airlines to achieve a balanced result across all four seasons,â adding that the review formed part of a wider turnaround program to âposition the core brand for the future.â

Analysis of schedules shows no Lufthansa operated flights from Frankfurt to Beijing after October 26. Notably, passengers will still be able to fly nonstop between the two cities with an âLHâ flight code, but with Lufthansaâs Star Alliance partner Air China. Munich-Beijing services are unaffected by the change.

Further capacity cuts were announced by LOT Polish AIrlines in early October. The carrier confirmed to Skift that it is canceling its Warsaw and Beijing service for the coming winter. A spokesperson cited âunsatisfactory booking results and a significantly weaker competitive position compared to carriers using shorter routes.â

The airline hopes to return to the Chinese capital next year, potentially turning its current year-round route into a seasonal affair.

Meet the Quitters

Tinkering around the edges doesnât work for everyone. Some major airlines are pulling out of China altogether. This isnât so much quiet quitting as, well, just quitting. Period.

In July, Virgin Atlantic announced its withdrawal from the country after 25 years. The last round-trip for the companyâs London to Shanghai route will be on October 25. The British airline cited âsignificant challenges and complexitiesâ for the commercially motivated decision.

Traveling westbound, Virginâs advertised journey time between the two cities is 14 hours and 20 minutes. By comparison, Chinese airlines can operate the same route in under 12 hours. Virgin will maintain a codeshare relationship with China Eastern Airlines. This effectively allows the British company to book passengers onto the Chinese plane using a Virgin Atlantic flight code and tap into transit traffic at its Heathrow hub. Virgin passengers lose out on its distinctive onboard service, but theyâll save hours in the air.

The dramatic move by Virgin is in stark contrast to comments made by its chief commercial officer just a few months ago. In late January, Juha Jarvinen described China and East Asia as âan incredibly important region for Virgin Atlantic.â

Recent decisions by the airline suggest the challenges are China-specific. In September, the airline announced new routes, including to Riyadh in Saudi Arabia and Accra in Ghana, where it believes it can better leverage its planes and people.

SAS Scandinavian Airlines recently joined Virgin in quitting China altogether. The carrier will operate its last service to the country on November 8 when it scraps the Copenhagen to Shanghai route.

SAS told Skift that âcurrent market conditionsâ were behind the decision, however it is keeping the door open for a possible re-entry. âChina remains an important market for SAS and we will actively monitor the situation to see if there are future opportunities to restore our presence in this important region, while continuing to serve our customers via other destinations in Asia.â

The Level Playing Field

Talk to airline executives at Europeâs biggest airlines and one term will be heard time and again â the need for a âlevel playing field.â

Speaking to Skift earlier this year, KLM CEO Marjan Rintel said the current two-tier approach where Chinese airlines can serve Europe via Russian airspace was unfair and called for regulatory intervention. âIt takes another two hours for us, four cockpit crew, and of course, more fuel, which is not the cheapest today. Itâs really frustrating and I think itâs harmful for relationships. We are in an international world and an international competition, so itâs very hard to have restrictions⦠that are not valid for others.â

Rintelâs counterparts at Lufthansa and Air France have also called for changes to rebalance the commercial operating environment. A common rebuttal in defense of Chinese airlines is that they are simply operating as usual. After all, it was European authorities that banned Russian planes from flying over Europe, leading to the tit-for-tat ban. Why should Chinese carriers be punished for a geopolitical fallout not of their making?

It’s Not Just Russia

Itâs easy to attribute such large reductions in European airline capacity to China as a direct fallout of the Russia-Ukraine war. However, this theory comes under serious strain when examining other global markets.

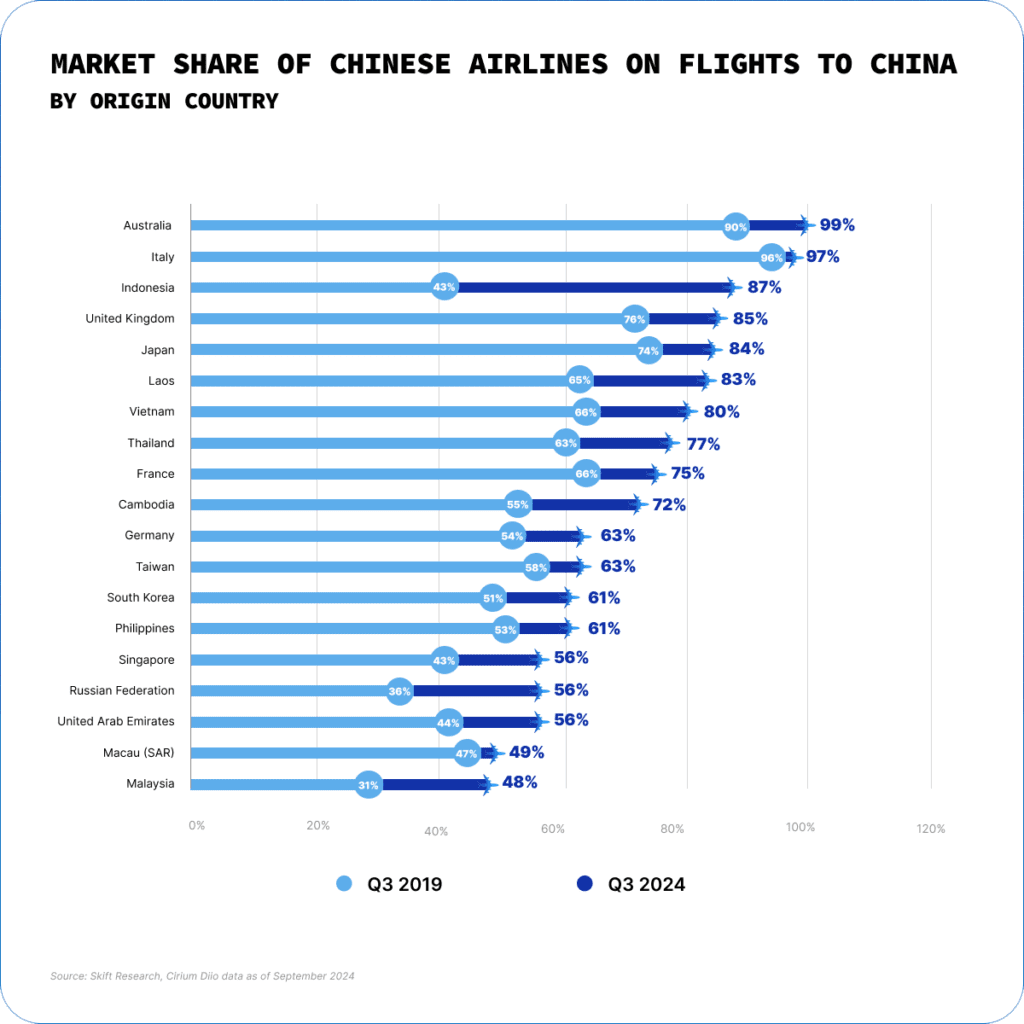

Despite being unaffected by the Russian airspace ban, Australian national carrier Qantas canceled its Sydney-Shanghai route in July, admitting its planes were often flying half-empty. The service was pulled just months after it was relaunched following the pandemic. It represented the only nonstop link flown by Qantas between Australia and mainland China.

Speaking to Skift in June, Qantas International CEO Cam Wallace said âgetting out of China at that point was the right call.â He admitted that a failed commercial partnership with China Eastern Airlines was a factor, but suggested wider considerations were at play.

âWe looked at the network and where we saw some opportunities for growth. We thought we could deploy the aircraft in a better way. Thatâs because supply [between China and Australia] came back at about 100% and demand came back at about 66%, so there was that economic mismatch which didnât give us the confidence to deploy the aircraft,â Wallace said.

Despite being Australiaâs national airline, Qantas had a tiny share of the market to and from mainland China. Skift analysis of Cirium data shows before the route was cut, Qantas flew five times a week between Sydney and Shanghai, offering just under 1,500 weekly seats. Its Sydney-Beijing route did not return after Covid-19.

During the same period, Chinese carriers operated more than 28,000 seats each week on 102 flights between mainland China and Australiaâs three largest cities. This is due to ramp up even further to 128 flights a week by eight different Chinese carriers by the end of the year.

Recent ticket sales data from ForwardKeys suggests Australia has increased in popularity among outbound Chinese visitors compared to 2019. This indicates that there is interest in the market â particularly during peak travel periods â but many Chinese travelers are choosing to fly with local companies.

The Economic Factor

After decades of unmatched growth, Chinaâs economy has slowed sharply in recent quarters. Profitable companies typically fly more, and corporations often pay higher fares compared to leisure passengers.

According to data from corporate travel management firm FCM Travel, bookings within the Greater China region enjoyed a strong rebound in 2023, growing 93% year-on-year. This puts it near or slightly surpassing pre-pandemic levels.

Calvin Xie, general manager of FCM Travelâs Greater China division, told Skift that cross-border travel also saw a resurgence, however, international corporate numbers have not yet reached pre-pandemic figures.

âChinaâs corporate travel is expected to rise, indicating continued demand,â said Xie. âInternational travel is projected to stabilize, suggesting that while the recovery is happening, global travel may take a little more time to fully return due to multiple reasons such as geopolitics and air capacity.â

Examining not just the number of people are flying, but how, Xie said there was evidence that with fewer nonstop flights available to China, more customers are traveling via major transit airports. âLast year, many travelers flew to the U.S. through Middle Eastern hubs such as Dubai and Istanbul. This year, however, we are seeing more travelers opt for routes through Hong Kong, Japan, and South Korea. We believe this shift is due to better pricing and more convenient schedules offered by the Asian hubs this year.â

Politics at Play

Chinaâs economy looks dramatically different today than before the Covid crisis. The country remains a world leader in key sectors such as electric vehicles and green power. Itâs still a manufacturing and export powerhouse. But its giant real estate sector – once a lynchpin of its rising wealth – remains in a prolonged slump and consumer spending is worryingly weak. Overall trade with the U.S. is robust, however, Washington no longer allows China to buy its most advanced technologies, including semiconductors that power many cutting-edge artificial intelligence products.

Jue Wang is an assistant professor at Leiden University in the Netherlands and a specialist in Chinese economic and political policy. Alongside the closure of Russian airspace, she highlights strained economic relations between China and the West as a key factor influencing recent airline decisions.

âIf the investment environment is vibrant and friendly then you will see Chinese delegations flying to look for opportunities and the other way around. But if the environment is bad, you don’t see those kinds of trips. Sometimes [businesses] take a trip looking for opportunities and end up going back with nothing. Even in that case you see more people traveling, but if the environment is tense, then people are discouraged to get on the plane to look for them.â

The tensions are not limited to China-Europe relations. Wang highlights the trade war between the United States and China as being a drag on economic growth – and by definition air travel demand – between the two superpowers.

âMany of the problems we see today started with the China and U.S. trade war. The business communities have been affected by the rising geopolitical tensions between China and the West. Very shortly after that, the world was hit by the pandemic.

âSome companies are considering relocating their manufacturing sites out of China. The Chinese companies in the high-tech sectors are facing the risk of being sanctioned by the United States and these punitive policies are potentially pushing others to decouple with China. We haven’t reached the point where the U.S. strictly says that if you do business with China, you’re out of the U.S. market – but people are worried that moment might come. They’re preparing for it, moving their production away from China or at least actively searching for alternative opportunities,â Wang said.

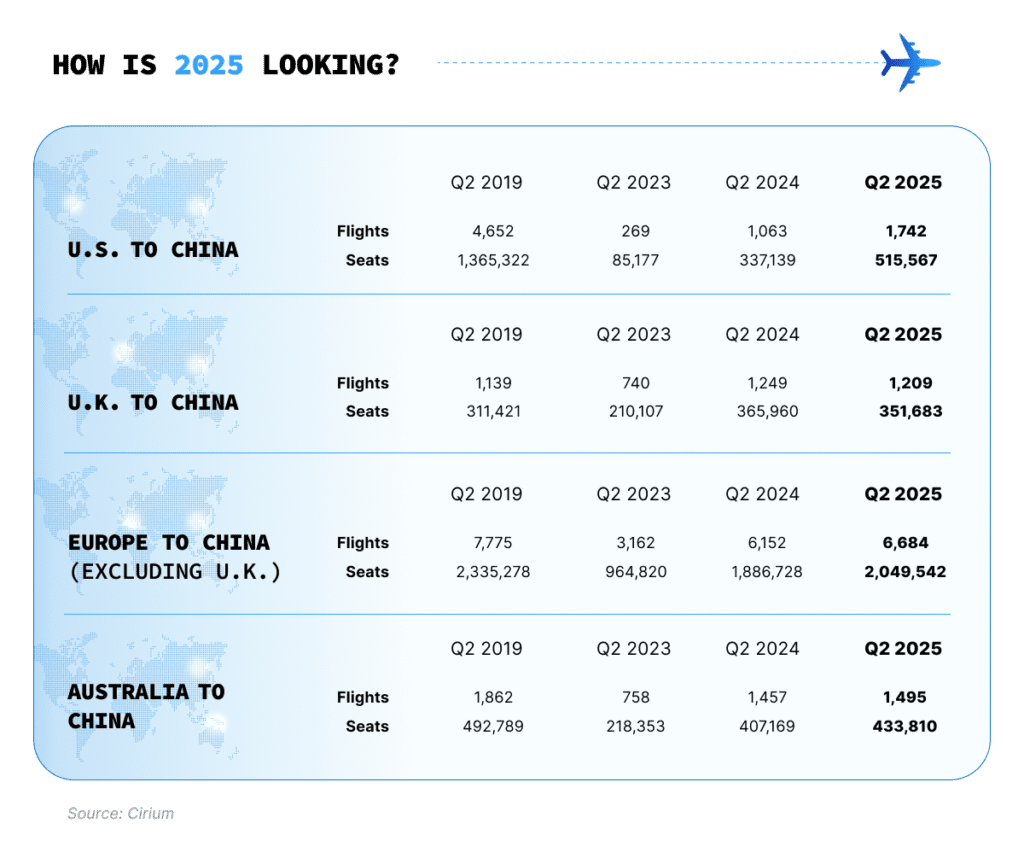

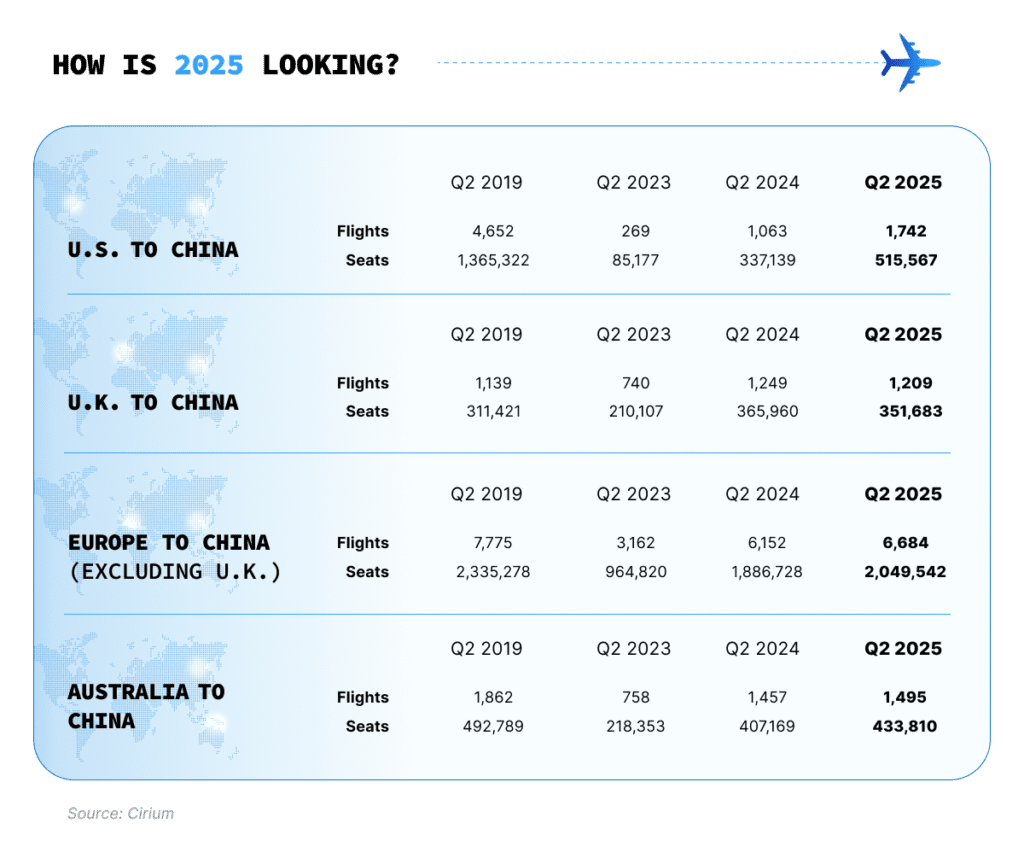

Flights between the United States and China were slow to rebound from the pandemic. Although frequencies between the two countries will more than double this year compared to 2023, it will still be just a quarter of pre-pandemic numbers.

Analysis of OAG data by Skift forecasts a total of 4,228 flights in 2024. Thatâs up from last yearâs 1,435, however, context is key. In 2019, there were more than 17,000 departures between the U.S. and China.

FCM Travelâs Xie reported that corporate demand on transpacific routes is improving as Chinese and U.S. airlines âgradually resumeâ more nonstop links. He highlighted the return of United Airlinesâ Los Angeles to Shanghai route as a step in the right direction.

Speaking during United Airlinesâ most recent earnings call on October 16, Andrew Nocella, the carrierâs CCO offered a valuable insight into the decision-making process. “China is just completely different for United today than it was pre-pandemic. The demand environment is just entirely different. We just recently resumed Los Angeles to Shanghai, and that will bring us to three daily flights. I really don’t anticipate – based on the demand we’re seeing – a lot more than that anytime soon. It’s just a completely different world.”

How Fair Are Todayâs Air Fares?

Attempting to remove geopolitics from the mix, a simple question remains: Do a lot of the changes weâre seeing come down to price? Even the most cursory of internet searches show a marked trend â Chinese airlines are often the cheapest for long-haul travel on key routes.

In recent decades, legacy operators such as Air France and British Airways have had to respond to intense competition from one-stop Middle Eastern carriers such as Emirates and Qatar Airways. Now, it seems a new front is opening in the battle for price-sensitive passengers.

Xie revealed that FCM Travel has observed a general decrease of 30% in average fares on routes where there is significant competition between foreign and Chinese carriers. He said this is largely due to increased capacity from Chinese airlines and their routing advantages over Russian airspace, adding that Chinese airlines can âadopt aggressive pricing strategies when aiming to capture a larger market share.â

Xie said the trend for the U.S. market is less pronounced, with strict capacity controls and higher demand relative to supply meaning price competition on these routes is less intense than elsewhere.

Even Gulf airlines with unobstructed access to China are reporting softness in bookings. Speaking exclusively to Skift, Arik De, Chief Revenue and Commercial Officer at Abu Dhabi-based Etihad Airways said demand was trailing other countries and regions. âThe one area that is coming back a lot later than we expected is China. Mainland China growth and demand is lagging others [and] remains relatively weak.â

De cited recent economic challenges as a factor but said the situation is more nuanced than some others have suggested: âDomestic consumption has taken a little bit of time to bounce back. Given the macroeconomic structural adjustments that are happening in China, that’s normal. When those changes happen, people first cut on things that they don’t necessarily need, and âneedâ is a very broad word.â

De noted that Chinese consumers are still flying, but they are often choosing destinations that are closer to home. âIf you look at Chinese [post-pandemic] recovery, people are traveling in China, but they’re traveling domestically and they’re traveling in near Asian countries such as Japan and Korea. Long-haul demand is definitely lagging, but that’s a reflection of macroeconomics and it’s temporary.â

In contrast to the quiet or not-so-quiet quitting strategies of some other major airlines, the Etihad CCO offered a bullish assessment. âAt the end of the day, China has a population of 1.4 billion people. At some point the current narrative will change and they’ll come back. For us, it’s important to keep investing and recognize that. There will be short-term hits, but you don’t build a long-term airline by running away when things are difficult.â

Gordon Smith is Skift’s Airlines Editor. Contact him at [email protected]

Graphics by Vonn Leynes

Have a confidential tip for Skift? Get in touch