Since the start of 2023, a tech rally has boosted countless tech stocks. Advances in high-growth sectors like artificial intelligence (AI) have highlighted the massive potential of companies active in related fields like chip design and cloud computing. Nvidia (NASDAQ: NVDA) has been one of the biggest recipients of the bull run, with its shares up 785% since January 2023.

The company profited from increased demand for AI chips and its ability to supply its hardware to most of the market. At the start of last year, Nvidia’s market cap was $360 billion. Yet, recent growth has seen it become the first chipmaker valued at more than $3 trillion, joining the ranks of companies like Apple and Microsoft.

Nvidia’s meteoric rise raises the question: what company could be next to hit such a milestone?

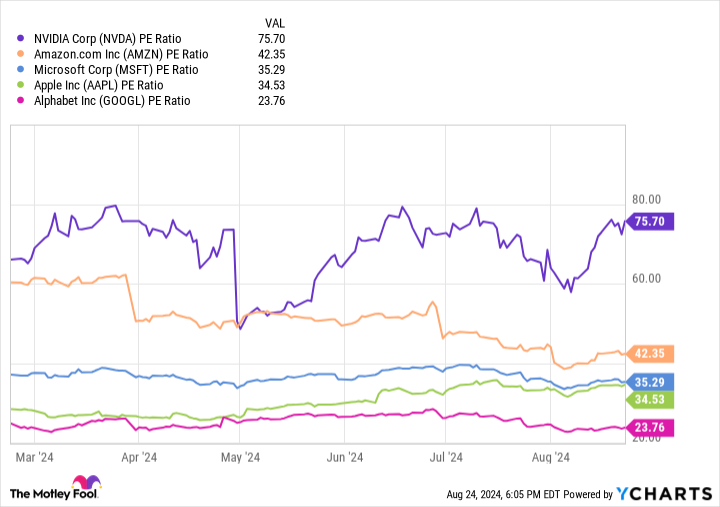

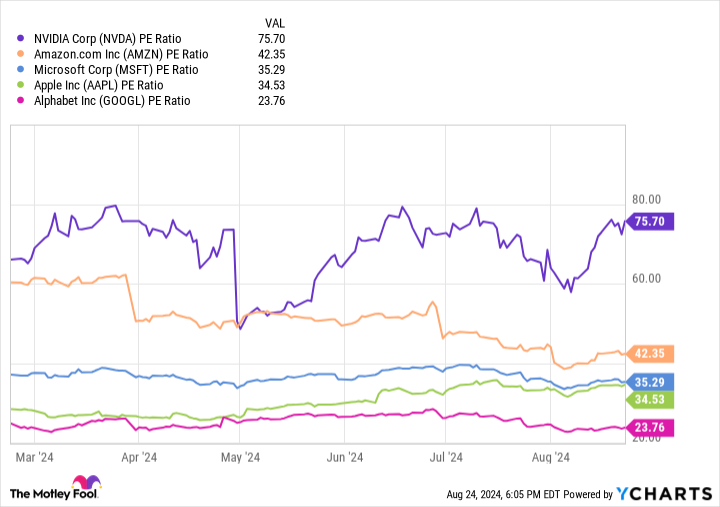

As the world’s fourth-most-valuable company, Alphabet‘s (NASDAQ: GOOGL) (NASDAQ: GOOG) market cap of $2 trillion puts it in a prime position to be the next company to cross the $3 trillion threshold. The tech giant has built itself into a cash cow with growth catalysts in multiple markets. Meanwhile, the chart below shows its stock is one of the best bargains in tech.

Alphabet’s stock is up 19% year to date, delivering more stock growth than any of these companies except for Nvidia. Yet, Alphabet boasts the lowest price-to-earnings (P/E) ratio among its peers, indicating its stock offers the most value.

So, here is an undervalued stock that could join Nvidia in the $3 trillion club.

Growth catalysts throughout tech

Alphabet has a potent position in tech, having expanded to multiple sectors of the industry. Hard-hitting brands like Android, YouTube, Chrome, and the many products under Google have made Alphabet the go-to for dozens of crucial services. The popularity of these platforms has seen the company amass a significant user base, hosting nine platforms that have achieved 1 billion or more users as of 2023.

Alphabet’s dominant role in tech is mainly thanks to consistent reinvestment in its business and willingness to try new ventures. This strategy has led to a long list of now-defunct products, with Google Hangouts, Stadia, and Google Glass just a few. However, Alphabet’s readiness to invest in promising industries has also allowed it to achieve lucrative roles in digital advertising, cloud computing, and AI.

The company has used its massive user base to sell ads on its various platforms, a business that now accounts for 78% of its revenue. The digital advertising industry is worth about $740 billion and is expanding at a compound annual growth rate (CAGR) of 7%, with Alphabet responsible for 26% of all global ad sales.

However, Alphabet’s biggest growth driver over the last year has been Google Cloud, with its 11% market share in cloud computing. The platform is expanding quickly, delivering revenue gains of 29% year over year in the second quarter of 2024. Cloud computing has become one of the fastest-growing areas of AI, an industry developing at a CAGR of 37% through 2030.

Google Cloud outperformed market leaders Microsoft’s Azure and Amazon Web Services in sales growth in Q2 2024 and has shown no signs of slowing. The platform is likely to boost earnings for years.

Alphabet delivers years of consistent gains

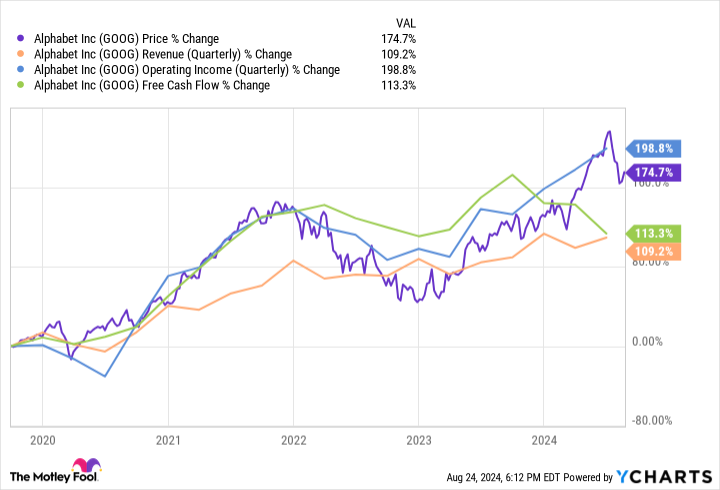

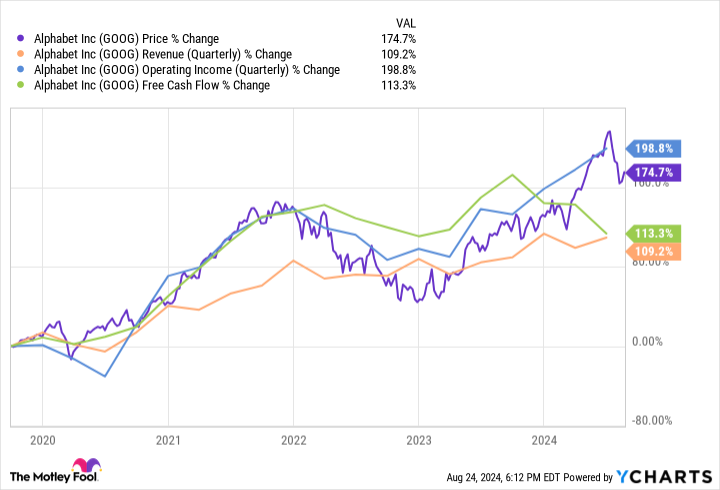

Alphabet has a reputation for consistent growth. In fact, an investment of $10,000 in its stock in 2014 would now be worth close to $58,000.

The tech giant has proven itself to be a king of reliability, suggesting that it’s more of a matter of when, not if, its market cap will hit $3 trillion.

The last five years haven’t been easy for many tech companies, with a worldwide pandemic in 2020 and multiple years of economic uncertainty. However, the chart above shows that Alphabet’s earnings and stock price have still delivered triple-digit growth in that time frame.

The Google parent’s free cash flow hit $61 billion this year, proving it has the funds to continue investing in its business and keep up with its rivals. Its P/E of 24 is shockingly low compared to its peers, indicating now is the time to invest in this undervalued stock that will likely join Nvidia in the $3 trillion club before it’s too late.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Undervalued Stock Could Join Nvidia in the $3 Trillion Club was originally published by The Motley Fool