It’s been a tough few months for Super Micro Computer (NASDAQ: SMCI), whose stock has come under pressure for a variety of reasons this year. The stock first dropped in April following a mixed reaction to its fiscal 2024 third-quarter results. That trend extended to its fourth-quarter earnings release in early August with declining margins worrying investors.

The company was then the subject of a short-selling report in late August from Hindenburg Research, which accused the company of accounting manipulation, evading sanctions, and related-party self-dealings by management. Not helping matters, the company delayed the filing of its 10-K shortly following the short report, though management has denied any wrongdoing.

On Sept. 26, the stock sank even further following a report from The Wall Street Journal alleging the Department of Justice (DOJ) is also investigating the company. Neither the DOJ nor the company have confirmed the investigation.

And most recently, Supermicro completed its 10-for-1 stock split on Oct. 1. These various developments have all made the stock very volatile with shares down 66% from their March peak. But Supermicro is still up over 45% year to date, and that raises the question: What should investors do with the stock now?

So what does Super Micro Computer do anyway?

Supermicro designs and manufactures servers and storage systems. It assembles what is commonly referred to as white box servers, which are basically the generic-brand versions of servers, using commercially available retail computer parts. It competes against other white box server providers as well as brand name offerings from Dell, Lenovo, and Hewlett Packard Enterprise.

The company has benefited from the massive data center buildouts as part of the artificial intelligence (AI) craze. The company’s revenue has been surging with 143% growth in its fiscal 2024 fourth quarter (ended June 30) to $5.31 billion. Supermicro has credited its next-generation air-cooled and DLC rack scale AI GPU platforms for its strong growth. These systems are used to stop servers from overheating and failing while also reducing energy costs.

While Supermicro has ridden strong AI tailwinds, it’s ultimately in a highly competitive, low-margin business without a lot of differentiation. Its revenue may have soared last quarter, but its gross margin sank to 11.2% from 17.0% a year ago and 15.5% the previous quarter. The company blamed its margin pressure on a combination of product mix, reduced prices to win new designs, and the costs of ramping up its direct liquid-cooled (DLC) rack scale AI GPU clusters. Management is projecting its gross margin will gradually improve throughout fiscal 2025 and return to a range of 14% to 17%.

An 11% gross margin is slim, and even 17% isn’t exactly robust. By comparison, the chip companies fueling the AI infrastructure buildout have much higher gross margins with both Nvidia and Broadcom boasting gross margins of at least 60% last quarter.

Should investors be worried by a possible DOJ probe?

At this point, the short report allegations against Supermicro are just that, allegations. And investors must be aware Hindenburg Research released the report in the hopes of driving the stock price down for the benefit of its short position. The firm succeeded in doing just that.

Meanwhile, the DOJ probe reported by The Wall Street Journal has remained unconfirmed by DOJ officials and company management.

That said, Supermicro has run afoul of U.S. regulatory agencies in the past. The SEC fined the company in 2020 over accounting issues after accusing the company of shipping products to warehouses at quarter-end and recognizing it as revenue before the products reached customers. The company ultimately agreed to pay a $17.5 million fine without admitting or denying the details of the SEC investigation.

Given this history, the Hindenburg report and DOJ news are a bit worrisome. However, Supermicro still sells real products, has real customers, and is benefiting from rapid AI development.

Time to buy the stock or stay away?

Even before the company’s latest headaches, I did not think Supermicro was a particularly good investment given its margin profile and pricey stock. Following these reports, the bull case becomes even harder to accept.

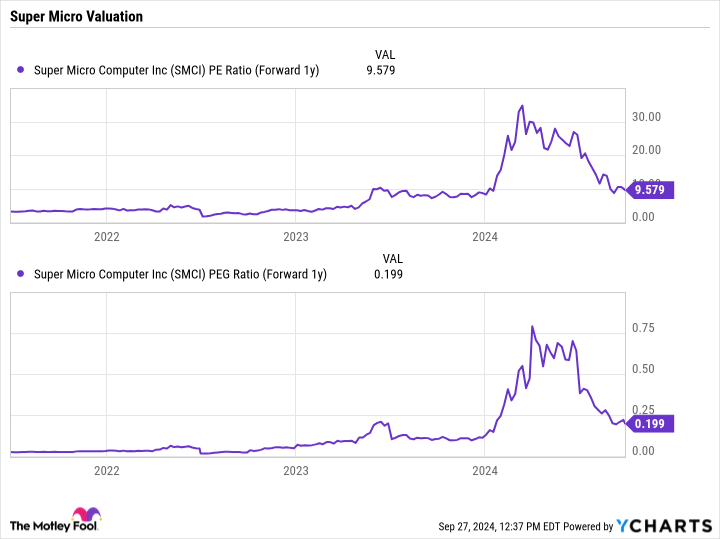

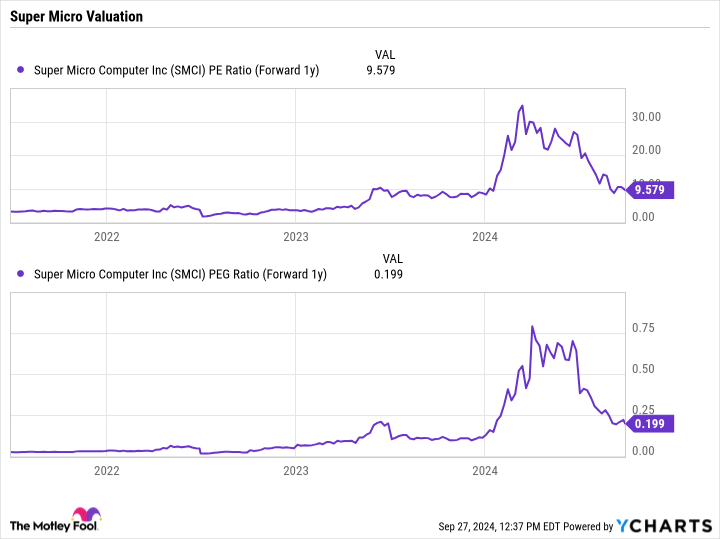

Regarding valuation, though, the recent sell-off has made the stock a lot more attractive with a forward price-to-earnings (P/E) ratio below 10 and a price/earnings-to-growth (PEG) ratio of just 0.2. A PEG ratio under 1.0 is generally considered undervalued. However, as the below chart shows, it has been pretty common for the stock to trade at even lower valuations in the past.

Given the uncertainty surrounding the stock, I’d stay on the sidelines. However, this is not a situation where investors should be rushing to sell out of their positions given Supermicro’s current valuation and the growth of AI-related spending.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Super Micro Computer Stock Tumbles on Recent News. Time to Buy or Stay Away? was originally published by The Motley Fool