Volatility briefly returned to the stock market earlier this month. It was a reminder that sell-offs can happen at any time and without any notice. The speed of the most recent market sell-off and subsequent recovery also showed that it’s good to have ready a list of stocks you’d buy during a sell-off so that you can pounce when the opportunity arises.

Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), Nucor (NYSE: NUE), and NextEra Energy (NYSE: NEE) are great stocks to buy during market sell-offs. Here’s why some of our Fool.com contributors think investors should buy them on any future dip.

A steady grower

Neha Chamaria (Brookfield Infrastructure): A sell-off is never easy; but when high-potential stocks get beaten down, smart investors know it’s an opportunity to grab shares while there’s time. Brookfield Infrastructure is one such stock you’d want to buy on every dip for three reasons: (1) its assets can churn stable cash flows, (2) it is growing steadily, and (3) management is committed to dividend growth.

To put some numbers to that, Brookfield Infrastructure grew its funds from operations (FFO) by nearly 11% in the first six months of 2024. The company acquires and operates regulated assets in sectors like utilities, transportation, midstream energy, and data infrastructure, and provides services under long-term contracts. That means it can generate steady cash flows even during challenging times. In between, it regularly churns its portfolio to sell off mature assets and reinvest the proceeds into projects with better returns potential.

Brookfield Infrastructure sold assets worth $1.4 billion in the first half of 2024 and expects to raise another $2.5 billion in proceeds in the coming quarters. The company’s already putting all of that money to use, having secured or completed seven follow-on acquisitions in 2024 so far with a combined enterprise value of nearly $4 billion.

There’s a lot of growth potential for Brookfield Infrastructure. It is targeting 10% FFO per unit and 5% to 9% dividend-per-share growth in the long term. With the units of the partnership also yielding 5.4% (shares of its corporate twin yield 4.4%), you could earn double-digit annualized returns from this stock even during tough times.

Nucor keeps getting better

Reuben Gregg Brewer (Nucor): The steel industry is cyclical and, in recent years, it has found itself dealing with periods in which cheap imports have flooded the U.S. steel market. This has resulted in big price swings for industry giant Nucor. Although steel demand appears likely to remain generally strong amid a building spree in the industrial (near-shoring) and tech (data centers) sectors, steel imports have been increasing again. That’s put pressure on sales and pricing after a series of very strong years for Nucor.

The end result is that Nucor’s financial results are currently in a downtrend. This is why investors have been selling the steelmaker’s shares, with the stock now down about 30% from recent highs.

But that’s actually pretty normal for Nucor, which has experienced numerous drawdowns of at least that much over the past five decades or so.

However, Nucor has never rested on its laurels, instead focusing on constant reinvestment in its business in good times and bad. That has included upgrading its existing production assets and, more important, expanding its production capabilities. A key focus has been creating value-added businesses that allow Nucor to use its own steel to make higher-margin steel products, like racks for data centers and garage doors for industrial properties.

Basically, despite operating in a cyclical industry, Nucor has continually become a more valuable business. This has shown up over the long term in higher stock prices, despite frequent price swings that can sometimes be a bit tough to watch. But, if you can stomach the volatility, buying when Nucor’s price dips has proven to be a great long-term plan.

A powerful wealth creator

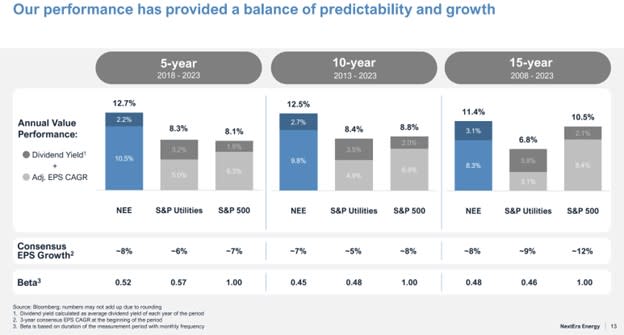

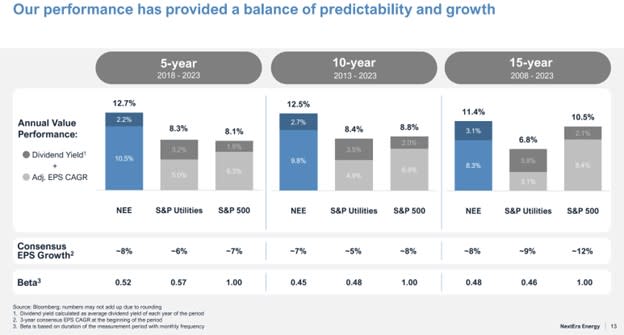

Matt DiLallo (NextEra Energy): NextEra Energy has a long history of growing shareholder value. The utility has grown its earnings at a 9% compound annual rate over the past decade. That has given it the fuel to increase its dividend by around a 10% compound annual rate. This combination of earnings and dividend growth has helped power robust total returns for its investors over the years:

Given the company’s prowess for producing above-average growth and returns, NextEra Energy typically trades at a premium valuation. Because of that, market sell-offs tend to offer the rare opportunity to buy this high-quality stock at a more attractive valuation.

Buying shares cheaper would enhance an investor’s ability to earn a strong return from NextEra in the future. The company is already in an excellent position to grow shareholder value. It expects to increase its earnings per share toward the upper end of its 6% to 8% annual target range through 2027. It also plans to boost its dividend by about 10% per year through at least 2026. Meanwhile, there’s a lot of long-term upside potential from the expected acceleration in electricity demand from AI data centers and other catalysts.

With a dividend yield of more than 2.5% and earnings growing by around 8% annually, NextEra has the power to produce double-digit annualized total returns from here. Meanwhile, buying shares during a sell-off would lock in a higher dividend yield and lower valuation, enhancing an investor’s ability to generate strong total returns over the long haul.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Matt DiLallo has positions in Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, and NextEra Energy. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Nucor. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

Stock Market Sell-Off: 3 Stocks You’d Want to Buy on Every Dip was originally published by The Motley Fool