Aurich Lawson | Getty Images

Yesterday, Microsoft announced that it made 31 percent less off Xbox hardware in the first quarter of 2024 (ending in March) than it had the year before, a decrease it says was “driven by lower volume of consoles sold.” And that’s not because the console sold particularly well a year ago, either; Xbox hardware revenue for the first calendar quarter of 2023 was already down 30 percent from the previous year.

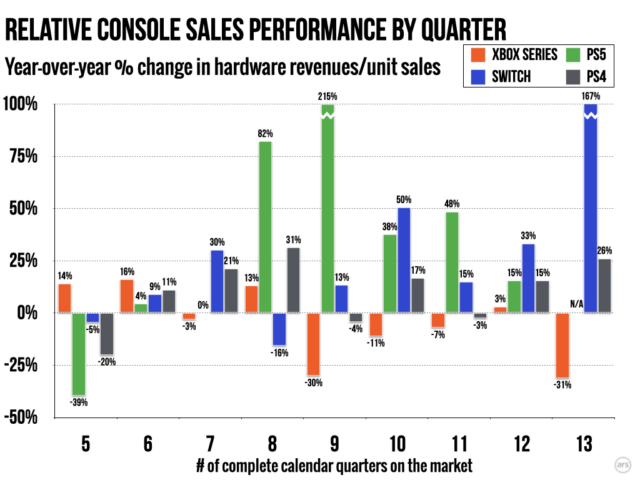

Those two data points speak to a console that is struggling to substantially increase its player base during a period that should, historically, be its strongest sales period. But getting wider context on those numbers is a bit difficult because of how Microsoft reports its Xbox sales numbers (i.e., only in terms of quarterly changes in total console hardware revenue). Comparing those annual shifts to the unit sales numbers that Nintendo and Sony report every quarter is not exactly simple.

Context clues

Kyle Orland

To attempt some direct contextual comparison, we took unit sales numbers for some recent successful Sony and Nintendo consoles and converted them to Microsoft-style year-over-year percentage changes (aligned with the launch date for each console). For this analysis, we skipped over each console’s launch quarter, which contains less than three months of total sales (and often includes a lot of pent-up early adopter demand). We also skipped the first four quarters of a console’s life cycle, which don’t have a year-over-year comparison point from 12 months prior.

This still isn’t a perfect comparison. Unit sales don’t map directly to total hardware revenue due to things like inflation, remainder sales of Xbox One hardware, and price cuts/discounts (though the Xbox Series S/X, PS5, and Switch still have yet to see official price drops). It also doesn’t take into account the baseline sales levels from each console’s first year of sales, making total lifetime sales performance on the Xbox side hard to gauge (though recent data from a Take-Two investment call suggests the Xbox Series S/X has been heavily outsold by the PS5, at this point).

Even with all those caveats, the comparative data trends are pretty clear. At the start of their fourth full year on the market, recent successful consoles have been enjoying a general upswing in their year-over-year sales. Microsoft stands out as a major outlier, making less revenue from Xbox hardware in four of the last five quarters on a year-over-year basis.

Aurich Lawson

Those numbers suggest that the hardware sales rate for the Xbox Series S/X may have already peaked in the last year or two. That would be historically early for a console of this type; previous Ars analyses have shown PlayStation consoles generally see their sales peaks in their fourth or fifth year of life, and Nintendo portables have shown a similar sales trend, historically. The Xbox Series S/X progression, on the other hand, looks more similar to that of the Wii U, which was already deep in a “death spiral” at a similar point in its commercial life.

This is not the end

In the past, console sales trends like these would have been the sign of a hardware maker’s wider struggles to stay afloat in the gaming business. However, in today’s gaming market, Microsoft is in a place where console sales are not strictly required for overall success.

For instance, Microsoft’s total gaming revenue for the latest reported quarter was up 51 percent, thanks in large part to the “net impact from the Activision Blizzard acquisition.” Even before that (very expensive) merger was completed, Microsoft’s total gaming revenue was often partially buoyed by “growth in Game Pass” and strong “software content” sales across PC and other platforms.

Activision

Perhaps it’s no surprise that Microsoft has shown increasing willingness to take some former Xbox console exclusives to other platforms in recent months. In fact, following the Activision/Blizzard merger, Microsoft is now publishing more top-sellers on the PS5 than Sony. And let’s not forget the PC market, where Microsoft continues to sell millions of games above and beyond its PC Game Pass subscription business.

So, while the commercial future of Xbox hardware may look a bit uncertain, the future of Microsoft’s overall gaming business is in much less dire straits. That would be true even if Microsoft’s Xbox hardware revenue fell by 100 percent.