Since the advent of the internet roughly three decades ago, investors have pretty much always had a buzzy trend or innovation to captivate their attention. However, none of these other next-big-thing trends came anywhere close to rivaling what the internet did for corporate America.

But after a long wait, the artificial intelligence (AI) revolution has left professional and everyday investors wide-eyed with its potential.

Although estimates vary, as you’d expect from a game-changing technology, the analysts at PwC see AI adding $15.7 trillion (yes, with a “t”) to the global economy via various consumption-side benefits and productivity gains by the turn of the decade.

No company has benefited more directly from the hype surrounding AI and its seemingly limitless ceiling than Nvidia (NASDAQ: NVDA).

Nvidia’s ascension is unlike anything we’ve ever witnessed

When the page turned to 2023, Nvidia was a $360 billion company that was on the fringe of being one of America’s most-important tech stocks. But as of the closing bell on Aug. 28, 2024, it was worth $3.09 trillion. In June, it briefly became the most valuable publicly traded company, shortly after completing its historic 10-for-1 stock split.

No deep digging is required to flesh out why Nvidia added, at one point, well over $3 trillion in market value in less than 18 months. In short order, the company’s H100 graphics processing unit (GPU) became the preferred chip in AI-accelerated data centers. It’s effectively the brain that powers generative AI solutions, facilitates the training of large language models (LLMs), and fuels split-second decision-making by AI-driven software and systems.

Demand for Nvidia’s hardware has completely overwhelmed supply. Producing the must-have AI-GPU has afforded Nvidia a jaw-dropping amount of pricing power. Whereas Advanced Micro Devices (NASDAQ: AMD) is selling its MI300X AI-GPU for between $10,000 and $15,000, Nvidia’s H100 generally costs between $30,000 and $40,000.

Nvidia’s CUDA software platform has played a key role in its success, too. CUDA is the toolkit developers use to build LLMs as well as get as much computing capacity out of their GPUs as possible. CUDA has been an indispensable tool that’s helped keep Nvidia’s customers loyal to its ecosystem of products and services.

The end result of this seemingly textbook expansion has been six consecutive quarters where the company’s reported sales and profits completely trounced the consensus of Wall Street analysts.

But in spite of this success, one under-the-radar performance metric appears to all but confirm that Nvidia’s best days are in the rearview mirror.

The first sequential decline in two years for this operating metric spells trouble

As I stated earlier this week, I wasn’t going to be shocked one bit if Nvidia blew past Wall Street’s consensus revenue and earnings per share (EPS) estimates for the fiscal second quarter (ended July 28) — which is precisely what it did. It’s not uncommon for analysts to be conservative with their estimates and provide a low enough bar for companies to clear.

But headline figures, such as revenue and net income, only capture part of the story.

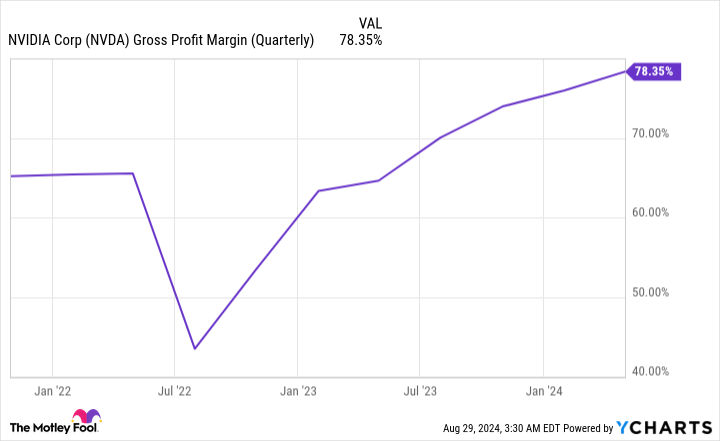

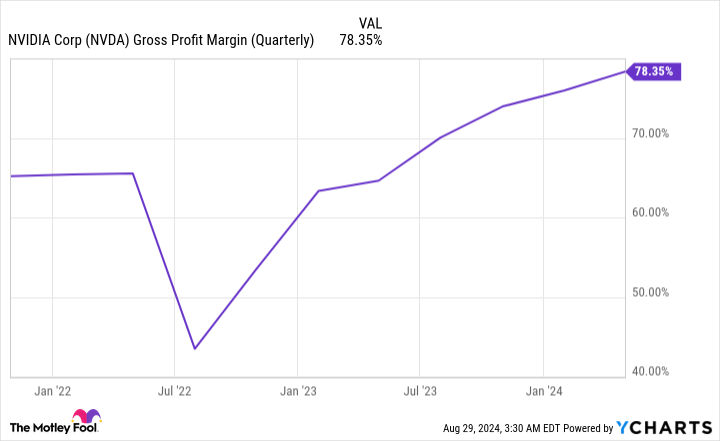

With Nvidia, the one performance metric that tells a more thorough story about where it’s headed is its gross margin. Personally, I prefer to use adjusted gross margin, which removes acquisition-related expenses and stock-based compensation; but either gross margin or adjusted gross margin works fine for this discussion.

During the fiscal first quarter (ended April 28), Nvidia’s adjusted gross margin expanded to an almost unthinkable 78.35%. In a span of five quarters, it’s risen by close to 14 percentage points, which is a reflection of the company commanding such high price points for its AI-GPUs.

However, Nvidia also guided to an adjusted gross margin of 75.5% (+/- 50 basis points) for the fiscal second quarter in its first-quarter report. If it were to hit this range, it would mark the first sequential quarterly decline in adjusted gross margin in two years.

After the closing bell on Wednesday, Aug. 28, Nvidia delivered its much-anticipated fiscal second-quarter operating results, with adjusted gross margin falling by 320 basis points to 75.15%. While this is within range of what the company forecast three months prior, it’s at the lower end of what was expected.

What’s more, Nvidia’s fiscal third-quarter outlook calls for the possibility of additional gross margin contraction, with an adjusted gross margin forecast of 75% (+/- 50 basis points).

Although its adjusted gross margin is still up substantially from where things stood 18 months ago, there appears to be no question that the tide is turning — and not for the better.

Competitive pressures and history are working against Nvidia

Even though Nvidia is selling more of its H100 chips, and CEO Jensen Huang has noted that demand remains strong for its next-generation Blackwell GPU architecture, the lion’s share of its adjusted gross margin expansion has been the result of AI-GPU scarcity and its otherworldly pricing power.

The first problem is that AI-GPU scarcity will be abating over time. AMD has been increasing production of its MI300X, and it doesn’t have the same supply constraints that Nvidia has contended with from leading chip fabricator Taiwan Semiconductor Manufacturing (NYSE: TSM). As external competitors enter the space and ramp their output, Nvidia’s pricing power will be steadily whittled away.

It’s also highly likely that suppliers are going to want a bigger piece of the pie. Taiwan Semiconductor is in the process of meaningfully expanding its chip-on-wafer-on-substrate (CoWoS) capacity, which is a necessity for packaging the high-bandwidth memory needed in AI-accelerated data centers. Increasing its CoWoS capacity is likely to translate into higher costs on Nvidia’s end to boost production.

And it’s not just external competition that this leading AI juggernaut needs to worry about. Nvidia’s four largest customers by net sales (all members of the “Magnificent Seven”) are developing in-house AI-GPUs for use in their high-compute data centers. The H100 and Blackwell GPUs maintaining their computing capacity advantages won’t to be enough to dissuade these top customers from using their in-house chips and denying Nvidia valuable data center “real estate.

The other major issue working against Nvidia is history. At no point over the last 30 years has there been a next-big-thing technology, innovation, or trend that’s avoided an early-innings bubble. All technologies need time to mature, and artificial intelligence doesn’t appear to be the exception to this unwritten rule.

Although Nvidia has enjoyed large orders from its top customers, the overwhelming majority of businesses investing in AI lack a clear game plan. Even Meta Platforms, which is one of Nvidia’s top four customers by net sales, has no intention of meaningfully monetizing its AI investments anytime soon.

This clear lack of direction, coupled with the company’s adjusted gross margin forecast, effectively confirms that Nvidia’s stock has peaked.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Nvidia’s Stock Has Peaked, and 1 Under-the-Radar Performance Metric Proves It was originally published by The Motley Fool