Chipmaker Could Give ‘Another Drop the Mic Performance,’ Wedbush Analysts Say

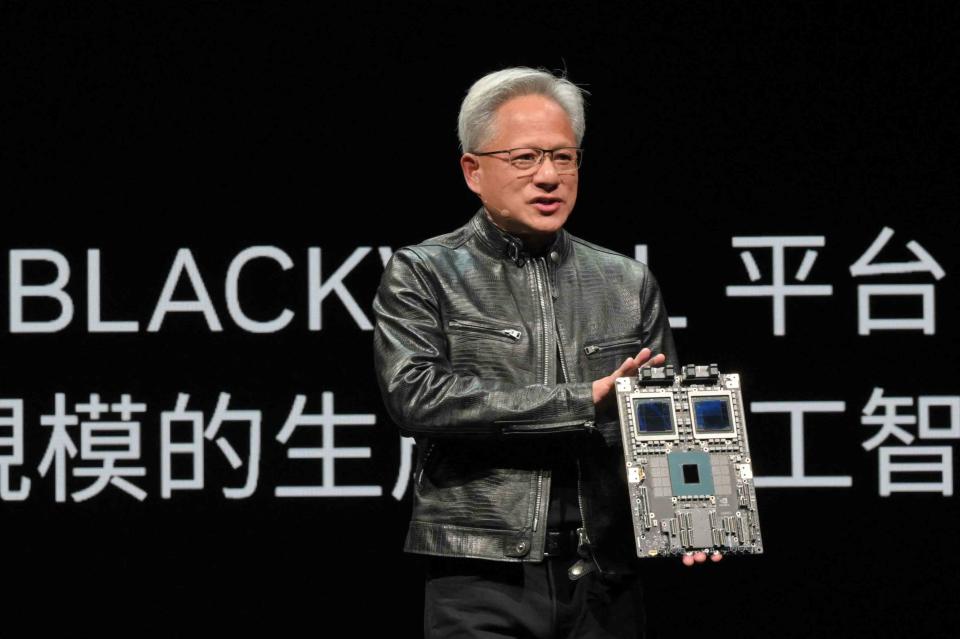

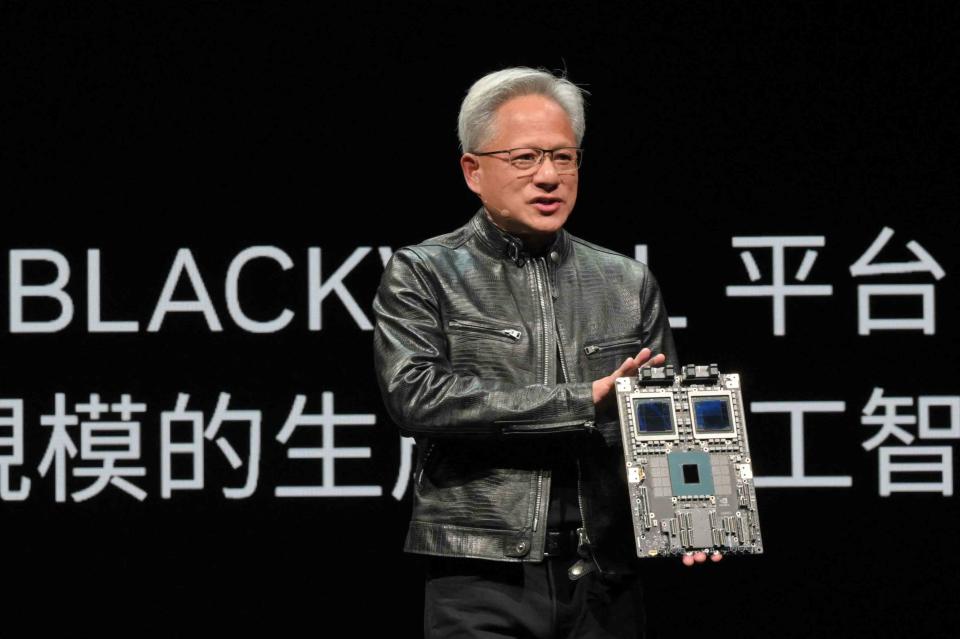

Sam Yeh / AFP / Getty Images

Nvidia CEO Jensen Huang delivers his keystone speech ahead of Computex 2024 in Taipei on June 2, 2024.

Key Takeaways

-

Expectations for Nvidia’s earnings release Wednesday are on the rise, in what could make it harder for the AI chipmaker to impress investors.

-

Consensus estimates for Nvidia’s second-quarter revenue and earnings climbed by hundreds of millions of dollars within the last 48 hours alone.

-

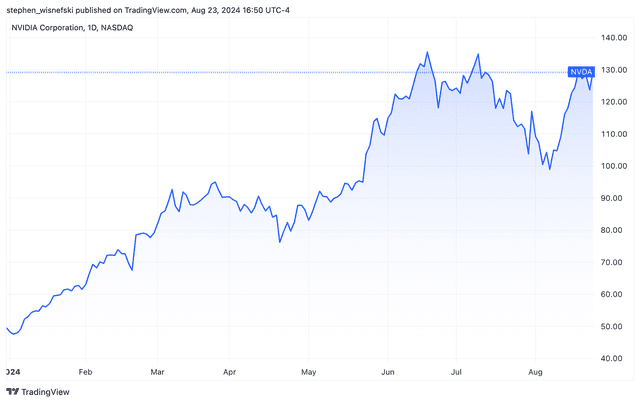

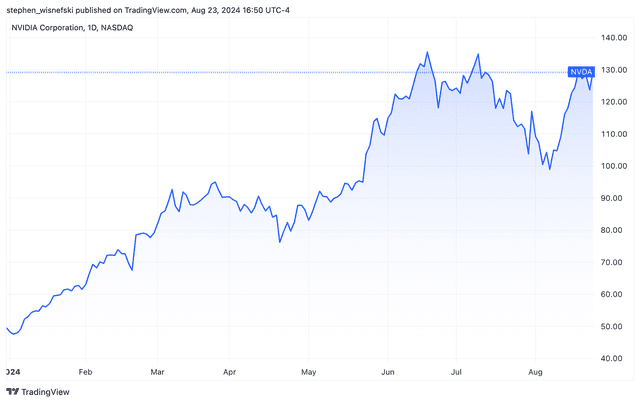

Nvidia shares gained more than 4% Friday and have risen about 160% since the start of the year.

Expectations for Nvidia’s (NVDA) earnings release Wednesday are on the rise, in what could make it harder for the artificial intelligence (AI) darling to impress investors.

Consensus estimates for Nvidia’s second-quarter revenue rose by $170 million to $28.84 billion in the last 48 hours alone, according to estimates compiled by Visible Alpha, while net income projections rose $120 million to $14.95 billion.

Whisper numbers could be even higher, with some analysts having long voiced concerns about investors’ expectations exceeding Wall Street projections.

Expecting Another ‘Drop the Mic Performance’

Wedbush analysts said Thursday they expect “another drop the mic performance from Nvidia,” citing signs of “massive enterprise AI demand” and spending by cloud giants such as Amazon (AMZN) and Alphabet’s Google (GOOGL), all trends that would benefit the chipmaker.

They’re not alone, as analysts from Raymond James, KeyBanc, and elsewhere recently said they expect a strong quarter from the chipmaker as well, despite concerns about a reported delay in Nvidia’s Blackwell AI chip.

Over 95% of analysts tracked by Visible Alpha have a “buy” rating for the stock, with a consensus price target of $144.83, 12% above Friday’s closing price.

Nvidia shares gained 4.6% Friday to close at $129.37. The stock has gained about 160% since beginning of the year.

Read the original article on Investopedia.