Today marks day one of the Democratic National Convention (DNC) in Chicago.

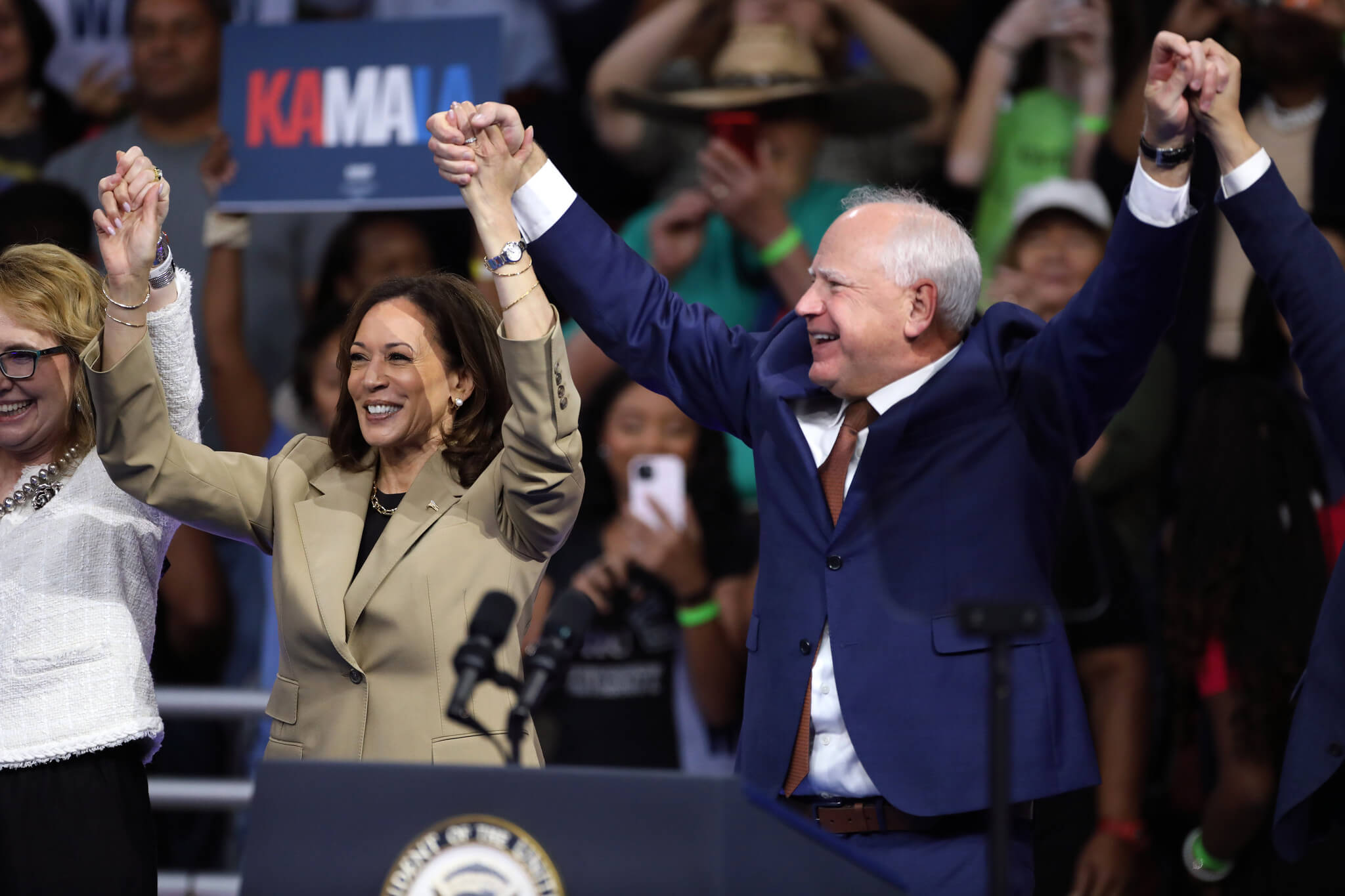

Ahead of the Chicago DNC, Democrat hopeful Kamala Harris announced a new federal program that would help first-time homebuyers. In Raleigh, North Carolina, on August 16, Harris rolled out a four year plan to tackle the country’s housing crisis. Harris said that the initiative is meant to help stymie inequality and build what she calls an “opportunity economy.”

“As president, I will work in partnership with industry to build the housing we need, both to rent and to buy,” Harris told the crowd in Raleigh. “We will take down barriers and cut red tape, including at the state and local levels. By the end of my first term, we will end America’s housing shortage by building 3 million new homes and rentals that are affordable for the middle class.”

Increasing Access

Homeownership rates are currently at their lowest since 1965 according to the American Bankruptcy Institute, which tracks foreclosures. If elected, Harris said she’d give 400,000 first-generation homebuyers $25,000 in downpayment assistance. Her longterm goal is to build 3 million new houses, which is 1 million more than what Biden had pledged.

Here, first-generation homebuyer connotes individuals whose parents do not own a home. Eligible applicants also need to have a history of making rent payments on time for at least the past two years, Harris said. Harris also floated a $10,000 tax credit for first-time homebuyers.

The proposal has been met with positive and negative reviews. While housing experts like Alexander Gorlin, co-author of Housing the Nation: Social Equity, Architecture, and the Future of Affordable Housing, applauded the idea; Republican pundits and celebrities have thrashed it.

Yes https://t.co/ooLCEECkJp

— Elon Musk (@elonmusk) August 16, 2024

Elon Musk was quick to denigrate the program on X. (Musk has already donated $45 million to secure a Trump victor for the GOP.) Other right wing analysts also castigated the idea. One hedge fund owner told Fox Business that the program is a “is a perfect formula to create inflation.”

Boosting Supply

Harris’s proposal follows other recent plans led by Democrats to decrease rent costs and boost homeownership rates. In July, Joe Biden said he would cap rent increases across the U.S. by 5 percent. Biden also said he wanted to build 2 million new houses before leaving office. Earlier, in March, Biden announced his ambition to crack down on the tight grip that hedge funds have on the single-family housing market.

The number of single-family homes owned by hedge funds today in the U.S. is relatively low. But by 2030, according to analysts from MetLife, approximately 7.6 million single-family rental homes (40 percent of the market) could be owned by private equity investors if current trends continue. And if that happens, the country’s affordability crisis will worsen, by a lot.

Legislators have floated new bills to buck this trend. Last January, Minnesota lawmakers proposed HF685, a bill that would prohibit hedge funds from converting single-family homes into rentals. In December 2023, Oregon Senator Jeff Merkley and Representative Adam Smith introduced the End Hedge Fund Control of American Homes Act.

This bill would pressure private equity firms from divesting from single-family housing over the next decade, and hedge funds would be banned from owning over 50 homes. Firms which don’t comply would be taxed $50,000 for each extra home over 50, and that taxation would support a “new housing trust fund for downpayment assistance” for aspiring homeowners.