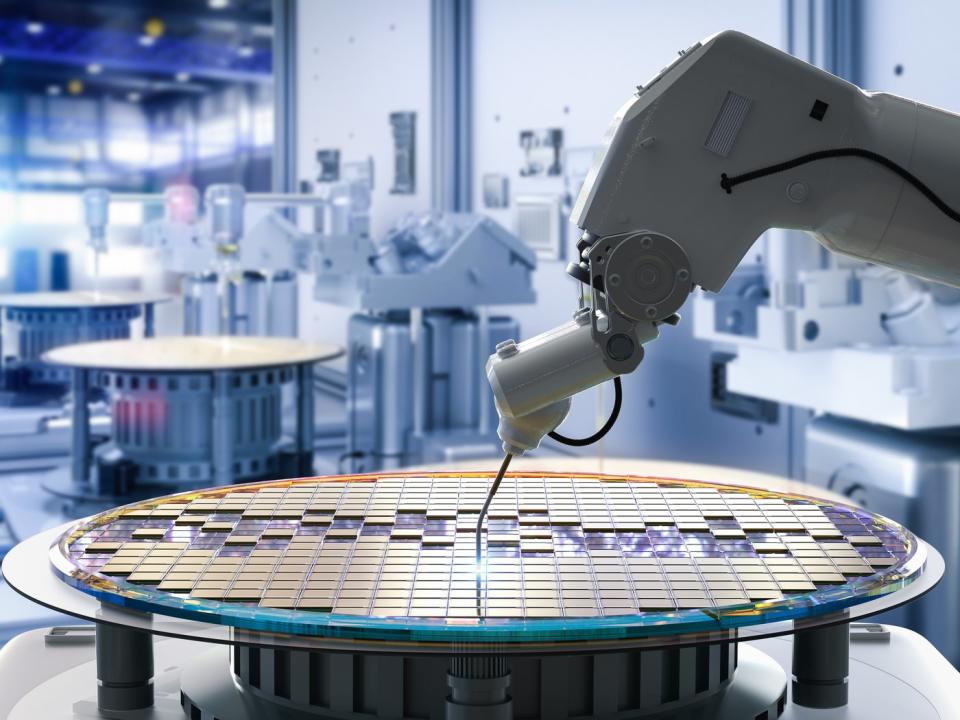

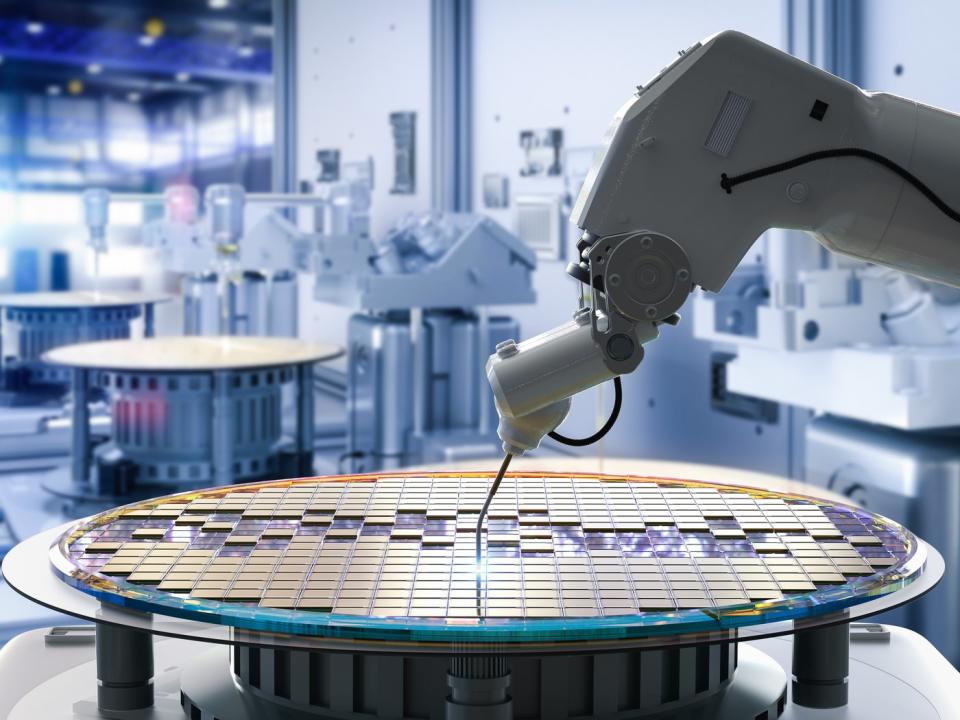

Believe it or not, semiconductor chips are used for applications well beyond powering smart devices and electronics. For this reason, it’s not entirely surprising that semiconductor stocks have been particularly big winners as the artificial intelligence (AI) revolution pushes forward.

Among leading chip companies, Nvidia (NASDAQ: NVDA) stands out as the 800-pound gorilla right now. But with shares up 651% since August 2022, investors may want to consider what opportunities exist in the chip realm besides Nvidia.

Let’s dig into how Nvidia propelled itself into being the world’s top chip business, and assess why another stock may be the better buy in the long run.

Nvidia is great, but …

Chips known as graphics processing units (GPUs) are used for a host of AI-powered applications such as training large language models, developing autonomous driving software, and machine learning. Nvidia’s GPU roster includes its highly popular H100 and A100 chips, and the company’s new Blackwell series is already forecast to be a smash hit (but more on that later).

Indeed, Nvidia looks downright unstoppable, with a nearly 80% share of the AI-powered chip market.

Nevertheless, I caution investors about going all-in on one company — even if it is the de facto leader. Below, I’ll break down in detail why Nvidia’s time at the top may be drawing to a close.

The competitive landscape is beginning to intensify

Many of the world’s largest companies are currently customers of Nvidia. In fact, many “Magnificent Seven” companies, such as Microsoft, Tesla, Amazon, Meta, and Alphabet, have been touted as some of Nvidia’s largest customers.

Although a customer roster of that caliber is impressive, I question whether it’s encouraging. Tesla CEO Elon Musk recently explained to investors that his electric vehicle company is exploring ways to compete with Nvidia more directly as Tesla looks to move away from a heavy reliance on H100 chips.

Furthermore, many of the Magnificent Seven companies referenced above have made it clear that they too are investing significantly into capital expenditures (capex) to develop in-house chips.

For example, I see Amazon’s $11 billion data center infrastructure project as a clear sign that the company is looking to increase investment in its Trainium and Inferentia chips.

What’s amazing is that all of the competitors analyzed above are tangential to Nvidia. Designing semiconductors isn’t a core component of any of their businesses.

Perhaps Nvidia’s most direct competitor at the moment is Advanced Micro Devices (NASDAQ: AMD). While AMD’s growth during the AI revolution hasn’t even been in the same universe as Nvidia’s, I think those dynamics may soon change.

Nvidia’s momentum has hit some turbulence following a recent announcement that the new Blackwell chips will be delayed due to a design flaw. Although I suspect Nvidia will still sell out of these chips when they finally do hit the market, I think AMD has an opportunity to capture some new business right now.

With all this said, I think it’s only a matter of time before Nvidia’s growth begins to decelerate. Subsequently, I would not be surprised to see the stock give back some of its record gains.

This company stands to win regardless

Given the sheer number of competitors and the risks that come with commercializing new products and services, you’re probably wondering which chip stock I actually do have full confidence in.

Enter chip manufacturing company Taiwan Semiconductor (NYSE: TSM). You see, Nvidia, AMD, and many others do very little of their own manufacturing. Instead, after designing next-generation hardware, they outsource the actual manufacturing capability to Taiwan Semiconductor.

Taiwan Semiconductor makes products for Nvidia, AMD, Amazon, Broadcom, Intel, Qualcomm, Sony, and many more.

According to data from Market.us, the total addressable market (TAM) for the global AI chip market is expected to grow at a compound annual growth rate (CAGR) of 31.2% between 2024 and 2033 — reaching a size of $341 billion.

To me, Taiwan Semiconductor stands to benefit no matter what company is selling out their chips. Moreover, given the high likelihood of additional GPUs coming to market from big tech and the bullish forecast for the AI chip market more broadly, I see Taiwan Semiconductor as a clear winner over the next several years.

Investors with a long-term horizon who are looking for alternatives to AI’s most obvious opportunities among mega-cap tech may want to seriously consider a position in Taiwan Semiconductor right now.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

If I Could Only Buy 1 Artificial Intelligence (AI) Semiconductor Stock Over the Next Decade, This Would Be It (Hint: It’s Not Nvidia) was originally published by The Motley Fool