Over the last 20 years, Chipotle stock has put up monster returns. Posting a total return level of 7,000% since its initial public offering (IPO), the stock has crushed the S&P 500‘s 459% return over that same time frame. Through strong same-store sales and unit volume growth, Chipotle has been able to consistently grow revenue and earnings over the last 20 years, rewarding shareholders in the process.

But today, Chipotle stock is expensive, sporting a price-to-earnings ratio (P/E) of 67. With thousands of restaurants across the United States, the stock is much less appealing from a growth perspective compared to 10 or 15 years ago. That is why investors looking for restaurant stocks should focus their research on small companies that could be the next Chipotle, or the restaurant stock that puts up market-trouncing returns for 15 years.

So, what restaurant is the next Chipotle? I think a fantastic candidate is Portillo’s (NASDAQ: PTLO). Here’s why investors should buy this beaten-down restaurant stock and hold it for the long term.

Unit volumes like Chick-fil-A

For those unaware, Portillo’s is a Chicago-centric restaurant concept that sells fast-casual Chicago street food. This means hot dogs, beef sandwiches, and more. It ended the year with just 84 restaurants, mainly centered around the Chicago area where it has been operating for decades.

Even though Portillo’s is not as well-known as the top restaurant concepts in the U.S., such as Chick-fil-A or Chipotle, it has some of the most impressive restaurant-level economics out there. According to management, restaurant average unit volumes (AUV) were $9.1 million in 2023. This is around the level of Chick-fil-A and highlights the rabid fanbase of Portillo’s Chicago-style street food.

In order to grow, Portillo’s management is taking the restaurant concept to new states, mainly focused on the Sun Belt, which includes Arizona, Texas, and Florida. The company opened 12 locations in 2023 and wants to grow its unit count by at least 10% per year going forward. Over the long term, Portillo’s management thinks it can expand its unit count tenfold before running up to any market saturation.

Highly profitable, but watch debt levels

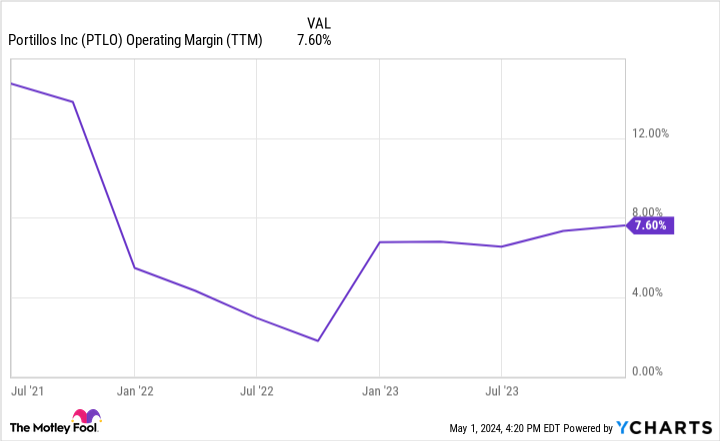

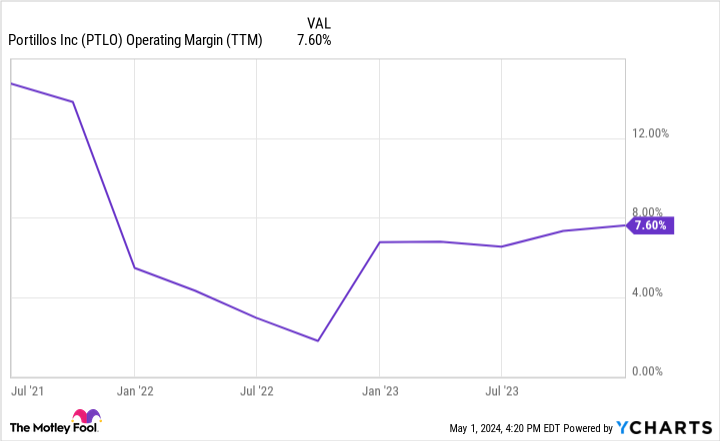

Portillo’s is not only a high-volume restaurant concept but also highly profitable. Its consolidated operating margin was 7.6% over the last 12 months and has been positive every year since going public in 2021. This is despite the company’s growth expansion and all the inflation hitting the food industry in recent years.

Investors would be smart to bet on margins marching higher in the coming years as well. Portillo’s restaurant-level profit margins — which excludes corporate overhead costs — were 24.3% in 2023. As the company scales to more locations, operating margins should slowly converge with restaurant-level profit margins as the company generates more revenue on its fixed corporate costs.

Assuming Portillo’s will hit 100 locations in the next few years and can eventually hit $10 million AUV due to inflation and same-store sales growth, Portillo’s will hit $1 billion in revenue soon. If it can expand its consolidated operating margins to 10%, that would equate to $100 million in annual earnings for this restaurant concept.

Is the stock a buy?

Portillo’s has a market cap of $890 million. With minimal cash on the balance sheet and over $600 million in debt and tax receivable liabilities with its old private equity owners, the stock has an enterprise value of approximately $1.5 billion as of this writing. Enterprise value takes into account net cash and debt positions on a company’s balance sheet to get a better estimate of the true price investors are paying for a stock.

Even adding back this debt, Portillo’s stock looks cheap if you believe this restaurant concept can keep growing its unit count and expand its margins. In a few years, it should be doing $100 million in earnings, which would give the stock an enterprise value-to-earnings (EV/E) of 15. This is cheap for a company with a long runway of growth ahead of it.

Over the long term, if Portillo’s can get to hundreds of locations across the United States and maintain its phenomenal restaurant-level unit economics, earnings should end up much higher than $100 million each year. It will have plenty of room to pay back its debt and tax receivable agreements, further generating value for shareholders.

For these reasons, Portillo’s looks like a monster restaurant stock and has the markings of the next Chipotle. Buy this stock and don’t sell it for many years.

Should you invest $1,000 in Portillo’s right now?

Before you buy stock in Portillo’s, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Portillo’s wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Forget Chipotle’s Stock Split: Buy This Monster Restaurant Growth Stock Instead was originally published by The Motley Fool