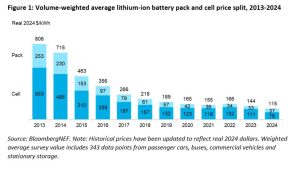

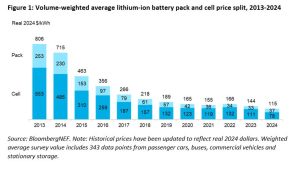

Battery prices saw their biggest annual drop since 2017. Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour, according to analysis by research provider BloombergNEF (BNEF)

Battery prices saw their biggest annual drop since 2017. Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour, according to analysis by research provider BloombergNEF (BNEF). Factors driving the decline include cell manufacturing overcapacity, economies of scale, low metal and component prices, adoption of lower-cost lithium-iron-phosphate (LFP) batteries, and a slowdown in electric vehicle sales growth. This figure represents a global average, with prices varying widely across different countries and application areas.

Over the past two years, battery manufacturers have aggressively expanded production capacity in anticipation of surging demand for batteries in the EV and stationary storage sectors. Currently, overcapacity is rife, with 3.1 terawatt-hours of fully commissioned battery-cell manufacturing capacity globally. That is more than 2.5 times annual demand for lithium-ion batteries in 2024, according to BNEF. While demand across all sectors saw year-on-year growth, the EV market – the biggest demand driver for batteries – grew more slowly than in recent years. Meanwhile, stationary storage markets have taken off, with strong competition across cell and system providers, especially in China.

Evelina Stoikou, the head of BNEF’s battery technology team and lead author of the report, said: “The price drop for battery cells this year was greater compared with that seen in battery metal prices, indicating that margins for battery manufacturers are being squeezed. Smaller manufacturers face particular pressure to lower cell prices to fight for market share.”

The figures represent an average across multiple battery end-uses, including different types of electric vehicles, buses and stationary storage projects. Prices for battery electric vehicles (BEVs) came in at $97/kWh, crossing below the $100/kWh threshold for the first time. While EVs have reached price parity in China, they are still more expensive than comparable combustion cars in many markets. BNEF expects more segments to reach price parity in the years ahead as lower-cost batteries become more widely available outside of China.

On a regional basis, average battery pack prices were lowest in China, at $94/kWh. Packs in the US and Europe were 31% and 48% higher, reflecting the relative immaturity of these markets, as well as higher production costs and lower volumes. The price differences for North America and Europe compared to China were higher than in other years, implying the drop in prices was more accentuated in China. Companies in China faced fierce competition this year. These conditions resulted in falling battery prices and lower battery margins, forcing many battery manufacturers to enter new markets, including energy storage, while also eyeing overseas markets willing to pay more for batteries.

The industry has also benefitted from low raw material prices. These could rise in the next few years, as geopolitical tensions, tariffs on battery metals and low prices stall new mining and refining projects.

Yayoi Sekine, head of energy storage at BNEF, said: “One thing we’re watching is how new tariffs on finished battery products may lead to distortionary pricing dynamics and slow end-product demand. Regardless, higher adoption of LFP chemistries, continued market competition, improvements in technology, material processing and manufacturing will exert downward pressure on battery prices.”

BNEF expects pack prices to decrease by $3/kWh in 2025, based on its near-term outlook. Looking ahead, continued investment in R&D, manufacturing process improvements, and capacity expansion across the supply chain will help improve battery technology and further reduce prices over the next decade. In addition, next-generation technologies, such as silicon and lithium metal anodes, solid-state electrolytes, new cathode material, and new cell-manufacturing processes will play an important role in enabling further price reductions in the coming decade.

SOURCE: BloombergNEF