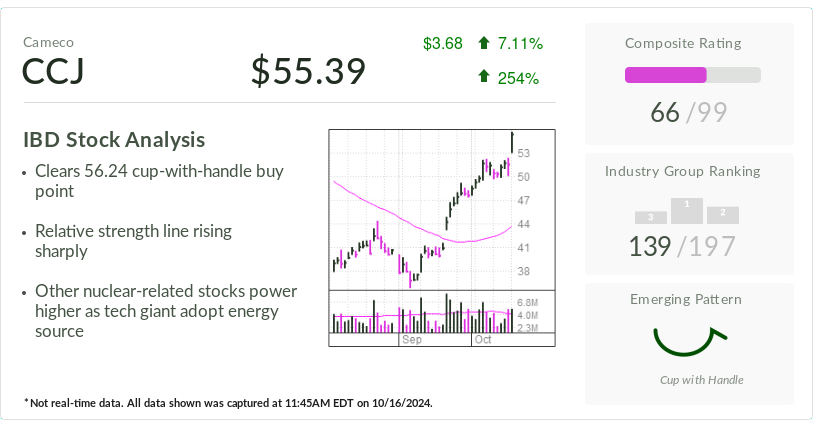

Cameco

Cameco

CCJ

$3.68

7.11%

254%

IBD Stock Analysis

- Clears 56.24 cup-with-handle buy point

- Relative strength line rising sharply

- Other nuclear-related stocks power higher as tech giant adopt energy source

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Cup with Handle

* Not real-time data. All data shown was captured at

11:45AM EDT on

10/16/2024.

Amazon.com (AMZN) announced Wednesday that it’s joining the nuclear renaissance, sending nuclear-related stocks higher, including Cameco (CCJ), Wednesday’s IBD Stock Of The Day.

The uranium refiner broke out past a buy point after Amazon said it has signed agreements to develop the emerging small modular reactor technology — joining a growing list of tech giants that are investing in nuclear power to run data centers.

S&P 500 leader Vistra (VST) and small-modular reactor play Oklo (OKLO) were among the other nuclear-powered stocks.

Top hyperscalers — the largest cloud, data center and AI operators — include Amazon.com, Microsoft (MSFT), Meta (META) and Alphabet (GOOGL). Amazon’s decision to invest in small modular reactors, or SMRs, comes just a day after a similar announcement by Google. SMRs do not currently exist but there are a number of companies working to develop the technology.

↑

X

Brace Yourself For A Market Top By Tracking Index Health With This Metric

In late September, Constellation Energy (CEG) announced a two-decade contract with Microsoft to provide nuclear power for the tech giant’s data centers. The deal involves reopening Pennsylvania’s Three Mile Island Unit 1, which had been idle since 2019. Three Mile Island’s Unit 2 reactor has been shut down since the 1979, after the partial meltdown at the nuclear power plant.

Morgan Stanley analyst David Arcaro wrote that the Constellation-Microsoft deal “proves out the value of nuclear power for hyperscalers, with higher prices for future deals.”

This is good news for Canada-based Cameco, which is one of the world’s largest providers of uranium with utilities around the globe relying on the company to provide nuclear fuel solutions.

AI And Nuclear

So far in 2024, nuclear power and utility stocks have been riding the artificial intelligence energy wave.

Artificial intelligence — and the data centers needed to train the systems — are expected to boost energy demand throughout this decade. In the U.S., McKinsey & Co. projects that data center energy demand will grow from around 4% currently to 11%-12% by 2030.

Bitcoin Miners Forge Lucrative AI Deals. They Have A Big Advantage.

Many technology companies are investing in or partnering with nuclear power providers to ensure energy supplies for their data centers.

Morgan Stanley analysts have proclaimed in recent months that a “nuclear renaissance” is underway.

They wrote that nuclear power, while still a divisive issue, is making a comeback. The firm sees $1.5 trillion in investment in new capacity through 2050.

Cameco Stock Performance

CCJ stock jumped 7.1% to 55.36 during market trade on Wednesday, gapping above a 52.32 buy point. The buy point runs to 54.94.

Cameco stock has gained 29% in 2024. The stock dropped more than 10% in August but has rebounded powerfully since early September.

Along with Cameco on Wednesday, S&P 500 leader Vistra, a nuclear power utilities play, jumped 4.5%. Fellow S&P 500 component Constellation Energy advanced 2.9%.

Meanwhile, Uranium Energy (UEC) leapt 9.4%. Uranium Energy engages in uranium exploration and development in the U.S. Southwest and Paraguay.

Oklo — the nuclear power startup backed by OpenAI head Sam Altman and with Peter Thiel as a major investor — surged 34% after clearing an early entry Tuesday. Fellow SMR-focused company Nano Nuclear Energy (NNE) leapt 13%. NuScale Power (SMR) soared 35%.

ARK Invest’s Cathie Wood has been building a position in Oklo worth more than $2 million since mid-July.

Cameco stock has a 66 Composite Rating out of a best-possible 99. It has a 62 Relative Strength Rating and a 42 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.