Tempestuous legal drama over the Chrysler Building between Cooper Union and real estate mogul Aby Rosen ended in decisive victory for the bonafide New York school this week. On October 31, Manhattan Supreme Court Judge Jennifer Schecter sided with Cooper Union when Chrysler Building tenants were ordered to pay rent directly to the school instead of Rosen’s company, RFR.

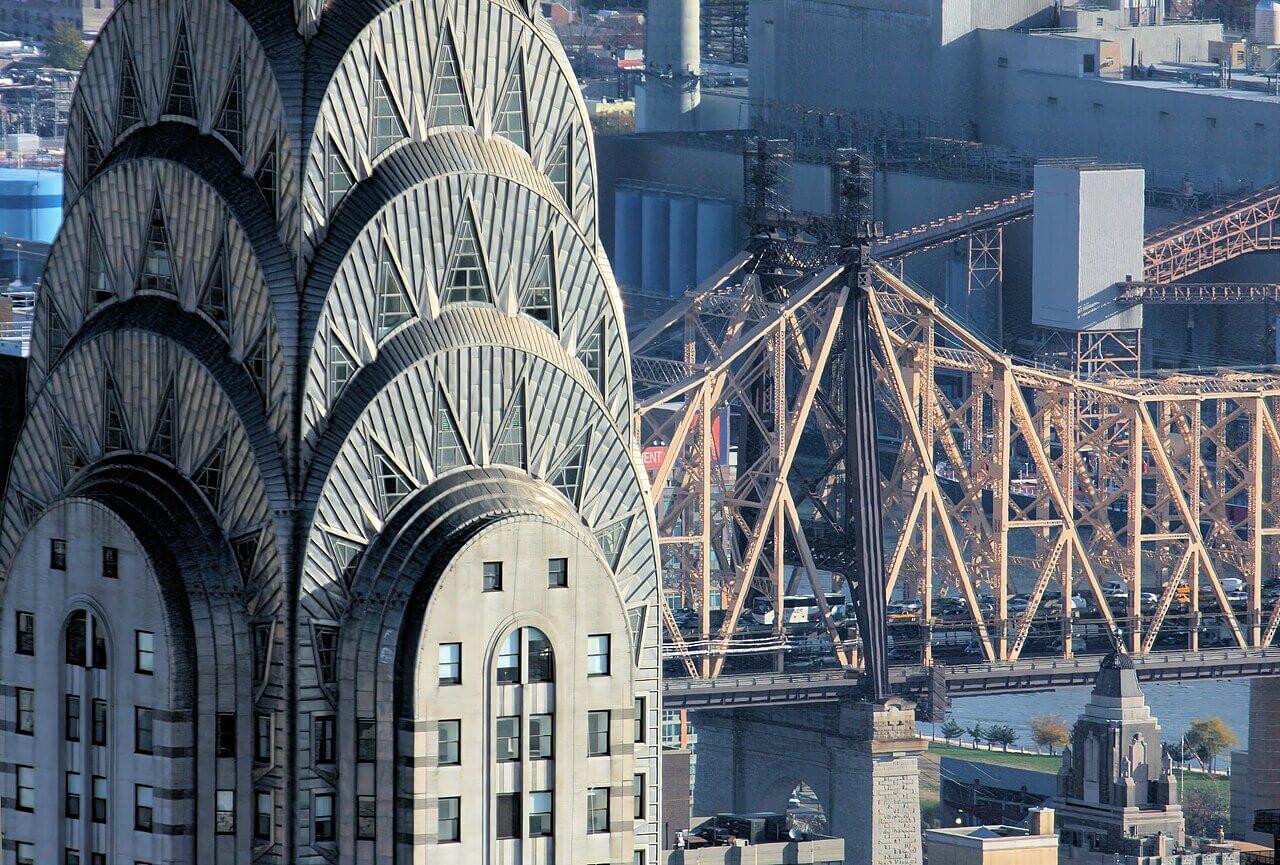

The Chrysler Building was completed in 1930, but Cooper Union has owned its ground lease since 1902. The rent Cooper Union accrues from tenants has historically helped subsidize the tuition-free education it provides students. Rosen’s company, RFR, has owned the Chrysler Building’s leasehold since 2019.

Previously, Rosen sued Cooper Union after the school opted to evict RFR from the premises on September 27. The Chrysler Building is roughly 60 percent leased—Cooper Union is now suing RFR for $21 million in back rent. Schecter will decide that case as well.

In a public statement by Cooper Union interim president Malcolm King after Schecter’s decision was announced on October 31, King said Cooper Union opted to evict RFR, the ground lessee since 2019, because it stopped making monthly ground lease payments, which resulted in “default of the ground lease agreement.”

King also that Cooper Union hired Cushman & Wakefield to help with the transition “for the building and our tenants who will pay their rent directly to Cooper Union.” He also said that none of this legal drama will “have an impact on student scholarship levels, nor on the recent announcement that seniors will attend tuition free in each of the next four years.”

“We have built important reserves and surpluses over the last seven years as part of our financial turnaround work and implementation of the Plan to Return to Full-Tuition Scholarships,” King elaborated. “We planned for a range of scenarios, including this one, and built in guardrails to our financial turnaround plan through fundraising, revenue generation, and expense management to protect against potentially negative events (such as COVID or a lease termination), all while holding tuition flat for six straight years and continuing to raise scholarship levels for students.”

Location, Location, Location

For RFR, the Chrysler Building hasn’t been the only thorn in its side. It wasn’t long ago when Aby Rosen, a German art dealer-turned-real estate big wig, was also forced out of Lever House, the tower at 390 Park Avenue by Gordon Bunshaft and SOM.

Waning demand for office space is forcing the New York real estate firm to tighten its belt and cut bait with some of its holdings, a recent article in Crain’s reported. Today, RFR is about $1 billion in debt on the Seagram Building, a cash cow that it may sell soon.

In Crain’s, Aaron Elstein intimated on July 29 that the Seagram Building’s likely buyer will be SL Green. Marc Holliday, SL Green CEO, has expressed interest in the 38-story structure completed in 1958 for the eponymous whiskey corporation. “It’s a great building,” Holliday told Crain’s. “There aren’t more than a few dozen that one would call really great buildings.” A listing price hasn’t been announced from RFR for Seagram Building, nor has the tower been officially put on the market.

In 2000, RFR bought the Seagram Buildingfor $380 million, or about $540 per square foot. If the sale goes through, SL Green would be the Seagram Building’s fourth owner. SL Green already owns 1 Vanderbilt by KPF and 245 Park Avenue (also by KPF), but Seagram would be much more than a trophy piece: SL Green has $1.3 billion in bills due ahead of the 2025 fiscal year. Holliday’s goal is to ultimately turn the Seagram Building into a moneymaker.

While commercial realtors around the country have struggled to find renters since COVID-19, the Seagram Building is in fact doing quite well. After Wells Fargo vacated the building in 2020, its current anchor tenant is Temasek International, the sovereign wealth fund of Singapore.

Seagram is landmarked, so if it were to switch hands from RFR to SL Green, no alterations could be made to its facade, plaza, or Four Seasons Restaurant by Philip Johnson on the top floor. But still, amenities have been added in recent years that may seem sacrilegious to purists.

To lure finance bros away from their home offices, RFR took the liberty of adding a pickleball court and rock-climbing wall inside the Seagram Building’s 24,000-square-foot underground garage. The decision paid off: Today, the tower is 98 percent occupied, which is up 8 percent from last year.