Super Micro Computer (NASDAQ: SMCI) stock got crushed today following a report that the company is being investigated by the Department of Justice (DoJ). The server specialist’s share price closed out the day’s trading down 12.2%, and it had been down as much as 18.6% earlier in the session.

The Wall Street Journal reported today that the DoJ is in the early stages of conducting an investigation into Supermicro. According to the report, the investigation is likely connected to allegations of bad accounting practices that were made in a short-seller note published by Hindenburg Research at the end of August.

Following today’s big sell-off, Supermicro stock is now down 66% from the high that it reached earlier this year. Despite the valuation pullback, the company is still on track to proceed with a 10-for-1 stock split that will take effect on Oct. 1.

Is Supermicro a buy ahead of its stock split?

Supermicro has been hit with some intense bearish pressures lately, but it’s possible that negative sentiment surrounding the stock has become overblown. For starters, the DoJ has not yet announced an official investigation into the company. Even if an investigation were to take place, that wouldn’t necessarily mean that any impropriety had actually occurred.

The Department of Justice has generally been applying more scrutiny to big-tech and financial companies lately, having has launched antitrust suits against companies including Apple, Alphabet, and Visa. Supermicro is unlikely to face antitrust scrutiny, but the DoJ’s recent surge of activity provides background context that’s worth keeping in mind.

If an investigation into Supermicro by the DoJ is underway, Hindenburg’s allegations that it had found evidence of new accounting violations by the tech company could have been a key catalyzing factor. But it’s important to keep in mind that Hindenburg is a short seller, and it profits when valuations for companies it has placed bets against decline.

The lack of visibility on the company’s outlook means that Super Micro Computer stock won’t be a good fit for investors without above-average risk tolerance. On the other hand, investors who are willing to embrace risk and uncertainty could wind up scoring big returns by treating recent sell-offs as a buying opportunity.

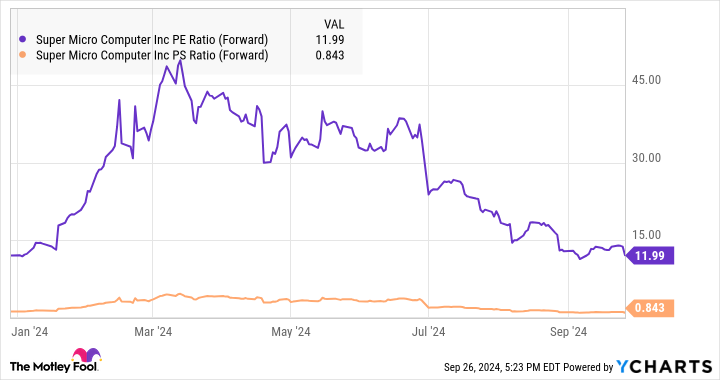

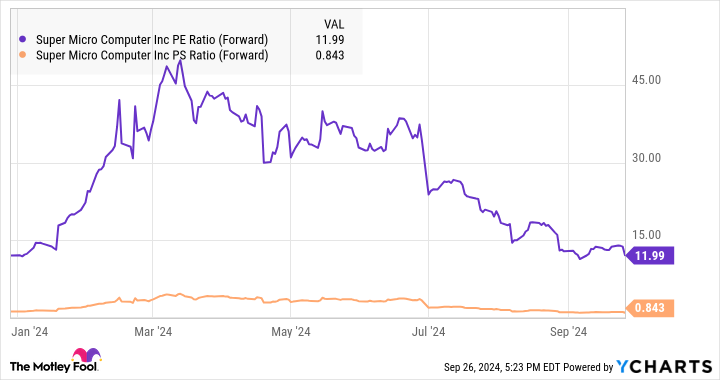

Following today’s stock pullback, Supermicro is now trading at just 12 times this year’s expected earnings and less than 85% of expected sales. Even with expectations that the business will see cyclical moderation, that’s a cheap-looking valuation for a company that has been seeing stellar sales and earnings growth thanks to artificial intelligence (AI)-driven demand. If the tech specialist scores wins with liquid-cooling technologies that help differentiate its high-performance rack servers, Supermicro stock could push through recent controversies and come roaring back.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, and Visa. The Motley Fool has a disclosure policy.

Super Micro Computer Plummeted Today — Should You Buy the AI Stock Before Its Stock Split on Oct. 1? was originally published by The Motley Fool