Let’s talk about insider trading. Not the illegal kind, but the perfectly normal – and fully legal – trading by top-level corporate officers. These are the C-suite residents and the members of the Boards, company officers who know what’s going on behind the scenes and are responsible to shareholders for bringing in profits. They typically hold shares in their own companies and make trades based on the knowledge they have from behind the scenes.

To keep the playing field level, federal regulators require that company insiders publish these transactions – and investors can benefit from seeing just which stocks the corporate officers are buying. There’s one thing to remember: company brass will sell their shares for a multitude of reasons, but they’ll only buy big when they believe the stock is on the way up.

So, let’s take a look at some recent insider trades. Using the Insiders’ Hot Stocks tool from TipRanks, we’ve pulled up the recent data on two stocks that have recently seen multi-million dollar buys from Board members. In each case, this is the first such purchase from the insider. With the significant outlay of the buy, that points to increased confidence in the company’s prospects for the near- to mid-term.

In addition to the recent high-value insider purchases, the TipRanks data shows us that both stocks feature Strong Buy ratings from the Street and solid upside potential for the coming year. Here’s a closer look at them.

Terns Pharmaceuticals (TERN)

First up is Terns Pharmaceuticals, a biopharmaceutical research firm working at both the early development and the clinical trials stages. The company has set its sights on the fields of oncology and metabolic disease, and has a clinical program underway in each of these areas, targeting chronic myeloid leukemia (CML) in the first and obesity, a major health issue, in the second. The company’s pipeline is composed of novel small molecule compounds, with clinically validated modes of action.

That’s a mouthful, but it comes down to a pipeline that features two Phase 1 clinical trials. The first of these features TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor, or TKI, designed to treat CML. This cancer starts in the bone marrow, where blood cells are formed, and is considered a chronic, life-long and life-threatening disease that frequently requires changes in therapies. Terns’ drug candidate, TERN-701, is undergoing the Phase 1 CARDINAL trial, a two-part study to evaluate the safety, pharmacokinetics, and efficacy of the drug. Interim data from the first cohorts of the dose escalation part of the study is expected for release this coming December.

Also of note on the clinical trial side is TERN-601, which has just completed a Phase 1 trial. This drug is an orally dosed, glucagon-like peptide-1 (GLP-1) receptor agonist, under investigation as an obesity treatment. The company released positive trial results from that study earlier this month, showing that TERN-601 produced a statistically significant weight loss in trial participants over a 28-day period. The drug was considered well-tolerated, and the company plans to initiate a Phase 2 trial next year.

Also on the obesity track, Terns has recently reported positive pre-clinical data from another drug candidate, TERN-501. This pre-clinical data supports using TERN-501 in combination with a GLP-1 receptor agonist as a treatment for obesity. The data showed that TERN-501, in the combo therapy, resulted in greater weight loss and a better retention of lean mass.

These clinical programs don’t come cheap, and Terns recently conducted a public stock offering to raise capital. The company offering, which saw more than 14 million shares made available, closed on September 12. Terns raised approximately $172.7 million in gross proceeds from the sale.

With that in mind, we can turn to the insider trades – and we see that Board of Directors member Lu Hongbo purchased 476,190 shares on the day the public offering closed. Hongbo paid nealy $5 million for this stock purchase.

This stock has also caught the attention of BMO analyst Etzer Darout, who likes the multiple catalysts lined up for it.

“With the obesity data from TERN-601 (oral GLP-1 agonist), TERN has delivered on a once-daily and clinically competitive drug profile for two of its three clinical programs (TERN-501, TERN-601) which gives us more confidence ahead of Phase 1 CML dose escalation data with TERN-701 (BCR-ABL allosteric) in December. With two partially de-risked clinical programs and another de-risking event upcoming, we continue to like the risk-reward for TERN and its setup for value creation in oncology and metabolic diseases,” Darout opined.

These comments back up Darout’s Outperform (i.e. Buy) rating on TERN shares, and his $26 price target points toward a potential one-year gain of 159%. (To watch Darout’s track record, click here)

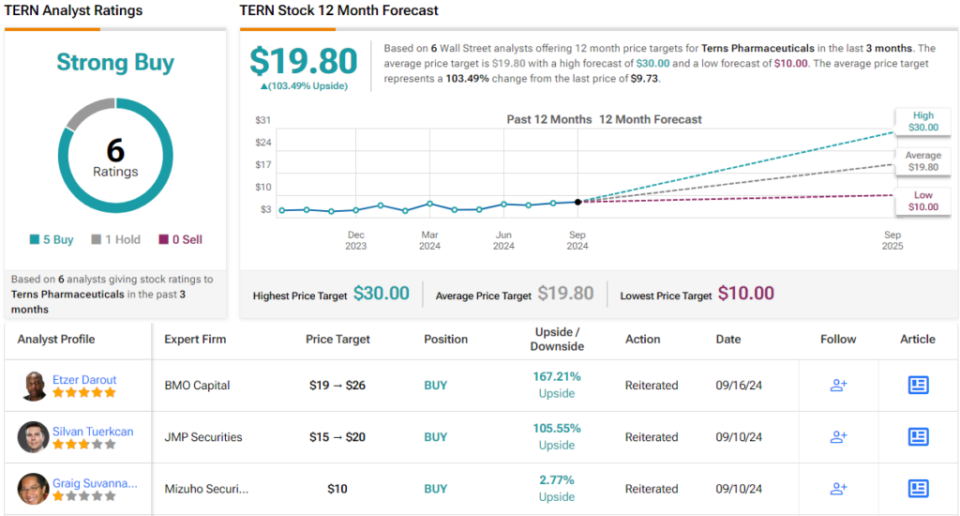

Overall, this stock’s Strong Buy consensus rating is based on 6 recent analyst reviews that split 5 to 1 in favor of Buy over Hold. The shares are currently trading at $9.73, and the average target price, $19.80, implies a 103% upside in the next 12 months. (See TERN stock forecast)

Permian Resources (PR)

For the second stock on our list, we’ll shift gears and look at the energy sector. Permian Resources is an independent oil and gas exploration and production firm operating in the rich oil fields of Texas. The company’s name gives away its game – Permian’s assets are located in the richest parts of the Permian Basin of Texas-New Mexico. The company’s land holdings total more than 400,000 net leasehold acres, which includes more than 68,000 net royalty acres. These holdings are focused in the Midland and Delaware Basins of the larger Permian formation, and some 45% of the production on these landholdings is crude oil.

This makes Permian one of the region’s largest pure-play hydrocarbon E&P firms, and on September 17 the company announced the closing of a bolt-on acquisition to its Delaware Basin assets. The acquisition, a deal with Occidental, added ~29,500 net acres and ~9,900 net royalty acres, along with a significant amount of midstream infrastructure, to Permian’s existing Reeves County, Texas positions.

In another update that should interest investors, Permian announced on September 3 a large increase to its regular base dividend. The dividend payment, formerly at 6 cents per common share, has been increased by 150% and is now set at 15 cents per share to be paid out starting in 3Q24. The new annualized rate of 60 cents per share will give a forward yield of 4.3% based on the current share value.

Permian attracted a recent large buy from an insider, company director William Quinn. Quinn made two purchases, on September 10 and 11, that totaled 312,429 shares – and cost more than $3.99 million.

Turning to the analysts’ view of the stock, we’ll check in with Truist’s energy sector expert Neal Dingmann, who sees Permian as one of the best stocks that he covers, with plenty of capital return and effective merger activities. In a note earlier this month, Dingmann wrote, “We believe PR operations continue to be among the best in our coverage with improving well results and lowering of unit costs while now adding an equally stable financial plan that will include notable share buybacks. Further, the high share overhang has been eliminated with existing private equity likely selling fewer shares going forward. The company also continues to have one of the more effective M&A strategies that will not change going forward with a focus on accretive additions in core areas. As such, we believe there remains notable share price upside potential with the current valuation not reflective of continued operational and financial success.”

For Dingmann, PR shares get a Buy rating with a $22 price target that implies an upside of 55% on the one-year horizon. (To watch Dingmann’s track record, click here)

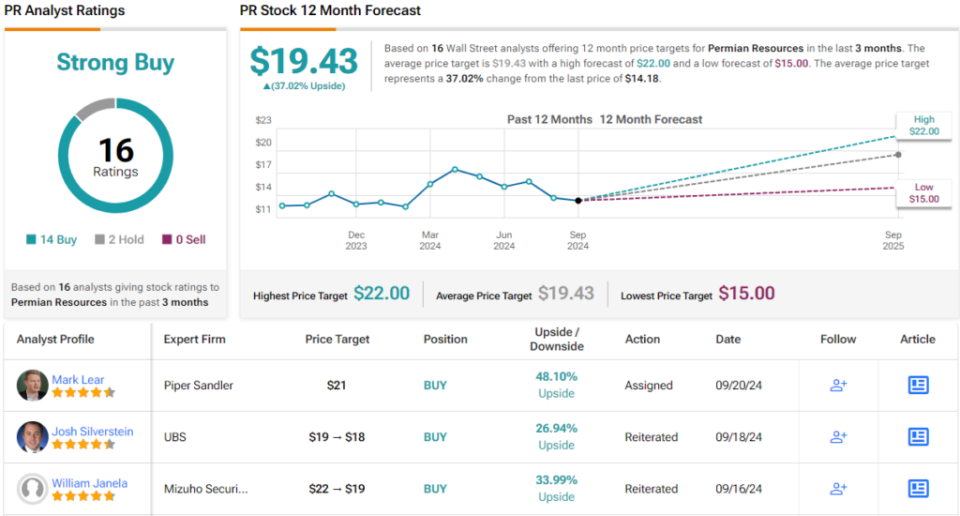

All in all, PR’s Strong Buy consensus rating is based on 16 reviews that include 14 Buys against just 2 Holds. With a trading price of $14.18 and an average target price of $19.43, Permian’s stock has a 37% upside this coming year. (See PR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.