TIMOTHY A. CLARY / AFP via Getty Images

GE Aerospace and GE Vernova chief executives and employees ring the opening bell at the New York Stock Exchange on April 2, 2024, when GE Vernova was listed

Key Takeaways

-

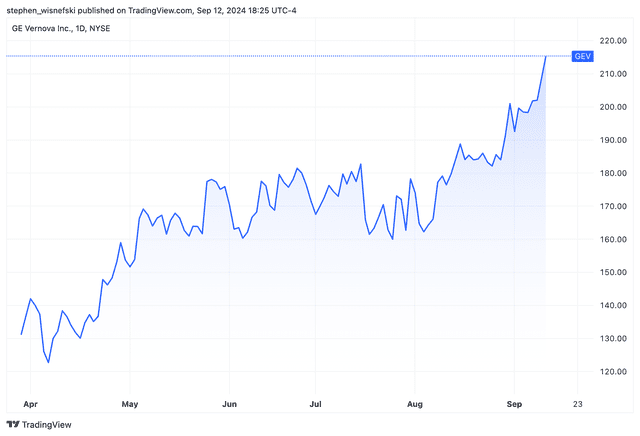

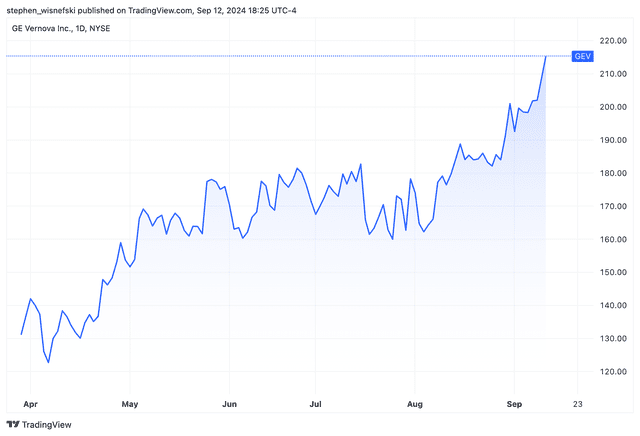

GE Vernova shares closed at their highest level since being spun off from General Electric in April.

-

The company said its offshore wind division should be profitable in the fourth quarter.

-

Strength in its power and electrification segments led the company to reaffirm its full-year guidance.

GE Vernova (GEV) closed at a record high Thursday after the recent General Electric spin-off reaffirmed its full-year financial guidance.

The energy company said Thursday at a Morgan Stanley investing conference that it expects revenue on the higher end of its previously disclosed $34 billion to $35 billion range, driven by strength in its power and electrification segments. Its offshore wind segment, which it projects to post a loss of $300 million in the third quarter, should be profitable by the fourth quarter.

Record Close Reached Thursday

Shares of GE Vernova climbed 2.9%, reversing an early-session decline, to close at $215.27.

The company began trading in April after General Electric spun off its energy division from the aerospace division, with the entities becoming GE Vernova and GE Aerospace (GE), respectively. GE Vernova’s shares are up more than 50% since their trading debut.

Read the original article on Investopedia.