Concerns about the economy have led to many e-commerce stocks struggling this year. Shares of Shopify (NYSE: SHOP), Wayfair, and Etsy are all down more than 10% in just the past six months. Even the mighty Amazon has barely managed to stay in the green during that stretch.

Investors are fearing the worst about a possible economic slowdown next year. But Shopify’s management thinks that the company is in a better position than many of its rivals.

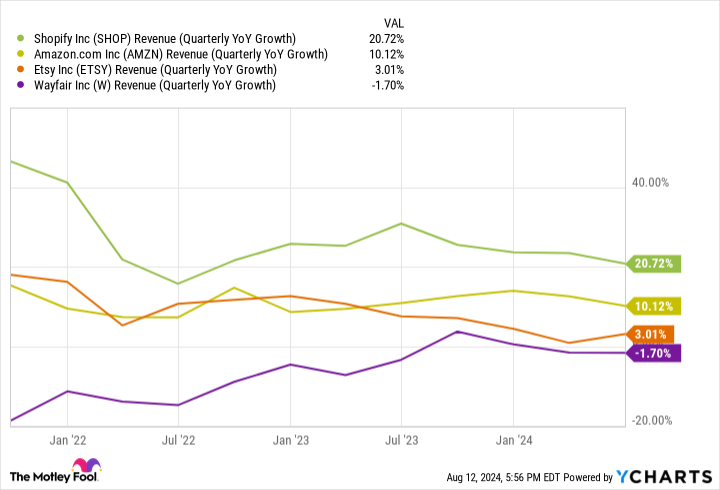

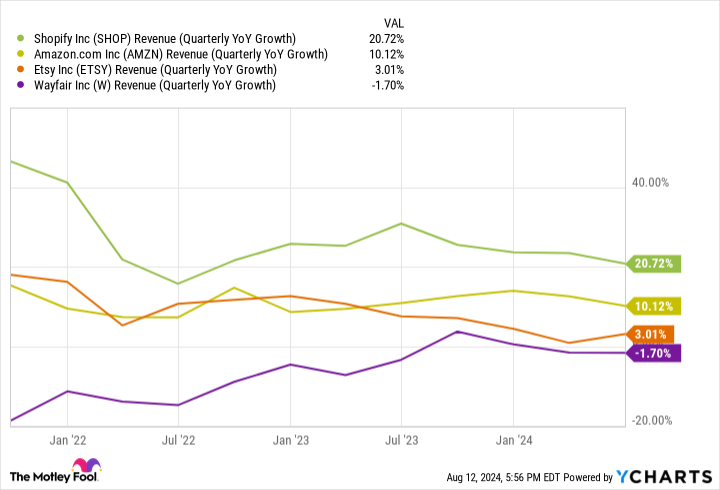

Shopify has been growing faster than its peers

On Aug. 7, the company released its results for the second quarter, ending June 30. Revenue totaling $2 billion for the period rose by 21% year over year. And when excluding the effects from the sale of its logistics business, that growth rate was even higher at 25%. For the current quarter, it still expects its revenue growth to be in the low to mid 20s percentages.

Shopify has typically been a top performer in e-commerce when compared to its rivals.

What is Shopify’s secret?

On the recent earnings call, Shopify’s president, Harley Finkelstein, highlighted two key reasons for the company’s strong success. “I think a big part of the reason that we are not seeing the same thing that others might is because we simply have merchants across a ton of verticals and across a ton of [geographies],” Finkelstein said.

What it ultimately comes down to is versatility. Merchants can sell on Amazon, Etsy, and Wayfair, but they have much more control over that process with Shopify. It can help them launch a store quickly and easily and integrate it onto their existing site. Or they might not have a website at all and just want to create an online store through Shopify.

As a result, the process is a lot more adaptable to varying business models, with the flexibility to meet the needs of merchants, regardless of the industry, product, or service — or even the part of the world that they are in. Shopify can help anyone sell online.

As Finkelstein alluded to, it is in more than 175 countries. Amazon, by comparison, has a broad global reach as well, and can ship products to more than 100 countries, but there are just 21 marketplaces. By being able to reach a wider and a more diverse set of merchants and customers, Shopify is less susceptible to specific market or industry conditions, and thus can generate better sales growth than its rivals.

Is Shopify stock a good buy?

Despite the company’s encouraging numbers, the stock is down 12% year to date. The business is generating good growth, but profits are still fairly thin, so the stock trades at 70 times its trailing earnings. Based on its price/earnings-to-growth ratio of 1.1, however, there could be some good value for investors who are willing to buy and hold for the long term.

But in the short run, depending on how the economy plays out, it could be a bumpy ride for the stock. The company’s business isn’t entirely resilient to the economy — Shopify’s growth did falter in 2022 as interest rates increased and consumers faced challenges due to inflation.

It’s doing well now, but investors shouldn’t assume that the stock is recession-proof by any stretch. It can and likely will feel the effects of a downturn, but its diversification can help ensure its growth doesn’t dip as sharply as it might for other e-commerce stocks.

Shopify can be a good long-term buy, but investors should temper their expectations; it might not be smooth sailing if the economy worsens next year. And its high valuation could make it vulnerable to a sell-off.

Should you invest $1,000 in Shopify right now?

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Etsy, and Shopify. The Motley Fool recommends Wayfair. The Motley Fool has a disclosure policy.

2 Things Putting Shopify Ahead of Its Rivals, According to Management. Time to Buy the Stock? was originally published by The Motley Fool