In a year shaped by a persistently weak economic environment, more intense competition and political challenges, the Brand Group Core continues to focus on successful model ramp-ups and execution of the performance programs in the various brands

In a year shaped by a persistently weak economic environment, more intense competition and political challenges, the Brand Group Core continues to focus on successful model ramp-ups and execution of the performance programs in the various brands. The Brand Group plans to boost profitability in the second half of the year through a clear focus on strict cost efficiency and the realization of synergies generated by cooperation, as well as through growth.

“The Brand Group Core made progress with its performance programs in the first half of 2024. However, despite all the cost-cutting measures already underway we need to reduce our fixed costs still further in order to stay firmly on course in this difficult market environment. The additional headwind is clearly evident in our key figures, particularly for the Volkswagen brand: fixed costs have risen in the first half of the year – and could not be offset by vehicle sales or sales revenue. Moreover, provisions for termination agreements at Volkswagen AG also affected earnings. Without special items we would have achieved an operating margin of 6.0% for our Brand Group Core, but we cannot afford to be satisfied with this performance, also bearing in mind that the share of electric vehicles – with their current lower margins – will increase going forward. It is vital that we continue to do all we can to execute our performance programs – and above all to systematically tap into the synergies between the brands in the Brand Group Core.”

Thomas Schäfer

Member of the Board of Management of Volkswagen AG, Head of the Brand Group Core & CEO of the Volkswagen Passenger Cars brand

“The figures for the Volkswagen brand show very clearly that, even taking the special items into account, our efforts so far to reduce costs are not sufficient. High fixed costs and one-off effects are significantly impacting profitability. Measures under the performance programs are already underway, but we still have a tough road ahead of us – and must remain consistent in order to secure the financial leeway needed for future investments and jobs on a sustainable basis.”

Patrik Andreas Mayer

Member of the Board of Management of the Volkswagen Brand responsible for “Finance”

Key figures

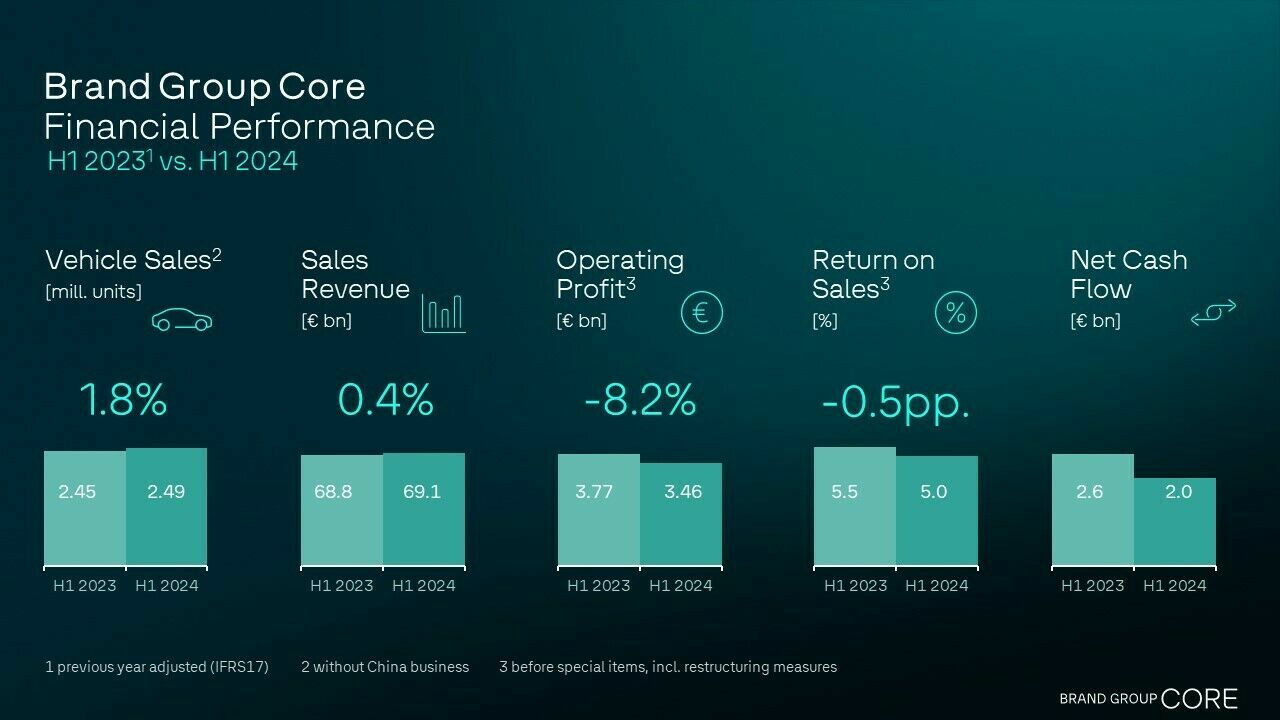

| Unit sales in the first half of the year grew slightly to 2.49 million vehicles (2.45 million vehicles in H1 2023)

Brand Group Core sales revenue came in at 69.1 billion euros, (68.8 billion euros in H1 2023) |

Unit sales grew 1.8% compared with the same prior-year period. Sales volume improved significantly in Q2/24 following stable development in Q1/24.

SEAT/CUPRA and Volkswagen Commercial Vehicles impressed with strong volume growth. Stabile sales revenue level with slight unit sales growth in a challenging competitive environment |

| Brand Group Core operating profit down 8.2% to 3.5 billion euros in the first half of 2024 (3.8 billion euros in H1 2023) | Higher personnel expenses compared with the same prior-year period due to collective agreement pay increases, provisions for termination agreements at Volkswagen AG, ramp-up costs for new models and supply chain constraints impacted operating profit and could not be offset by volume growth. |

| Brand Group Core return on sales came in at 5.0% in the first half of the year (5.5% in H1 2023) | Adjusted for provisions for termination agreements, the operating return came in at 6.0%, higher than H1 2023. |

| Net cash flow of 2.0 billion euros was 21.6% lower than the comparable prior-year period. | Higher inventories as a result of the model offensive and a rise in receivables led to a decrease in net cash flow |

Outlook

In a year shaped by a persistently weak economic environment, more intense competition and political challenges, the Brand Group Core continues to focus on successful model ramp-ups and execution of the performance programs in the various brands. The Brand Group plans to boost profitability in the second half of the year through a clear focus on strict cost efficiency and the realization of synergies generated by cooperation, as well as through growth. The performance programs in the brands are already expected to have an increasing effect on earnings in the coming months.

The Brand Group Core reached several milestones in the first half of the year with the launch of attractive model innovations such as the Tiguan, Golf, T-Cross and the all-electric Volkswagen ID.7 Tourer. At the same time, as expected, earnings were affected during the early stages of these new models. The Brand Group Core therefore anticipates significantly more positive momentum in the coming months, as the market presence of the new models intensifies.

The Brand Group Core remains on course to meet its target of lifting the operating return to 8 % from 2026: to this end, the Brand Group is placing a clear focus on the strict execution of the performance programs to reduce costs and boost productivity, and on further reducing complexity, shortening development cycles and systematically tapping into synergy potentials.

Overview of the brands in the Brand Group Core

Volkswagen Passenger Cars

Volkswagen Passenger Cars delivered 1,518,756 vehicles in the first half of the year, 0.3% down on the comparable prior-year period. Sales revenue decreased by 1.8% to 42.2 billion euros. The 41.1% decrease in operating profit before special items to 966 million euros is attributable to higher wages, provisions for termination agreements and ramp-up costs. As a result, the operating return for the first half of 2024 decreased to 2.3% (previous year: 3.8%).

Škoda Auto

Škoda Auto posted solid sales revenue and financial results in the first six months of 2024. Deliveries grew 3.8 % to 448,600 units and the financial data underscore the brand’s strong position: operating profit increased to 1.147 billion euros (2023: +25.9 %), sales revenue ran at 13.652 billion euros, thus continuing on a similar level to H1 2023 (-0.7 %), and the operating return increased to 8.4 % (6.6 %). For the first time, Škoda ranked fourth in European registrations, confirming that its balanced mix of ICEs, plug-in hybrids and BEVs is welcomed by customers.

SEAT/CUPRA

SEAT/CUPRA reported strong volume growth in the first half of 2024, with vehicle deliveries running at 344,313 units, an increase of 8.5% compared with the same prior-year period. Sales revenue grew 4.6% to 7.8 billion euros. Operating profit before special items grew 9.4% to 406 million euros, and the operating return grew 0.2% to 5.2%. These figures confirm the growing popularity of the SEAT/CUPRA model range.

Volkswagen Commercial Vehicles

Volkswagen Commercial Vehicles (VWN) got off to a strong start in the first half of 2024. Unit sales grew by some 9% to 231,262 vehicles, with sales revenue growth on a similar level, coming in at 8.1 billion euros. Operating profit before special items increased to 641 million euros (+42.9%), despite the charges from provisions for termination agreements. The operating return was therefore 7.9% (+1.9ppt).

Key figures for the Brand Group Core

| Key financials | H1 2024 | H1 2023 | Change

H1 24 / H1 23 |

|||

| Unit sales (thousand units)

(incl. vehicles from other brands) |

2,494 | 2,450 | 1.8% | |||

| Sales revenue | 69,051 million € | 68,764 million € | 0.4% | |||

| Operating profit before special items (including restructuring measures) |

3,462 million € |

3,773 million € |

-8.2% |

|||

| Operating return before special items (including restructuring measures) |

5.0% |

5.5% |

-0.5%-points |

|||

| Net cash flow | 2,005 million € | 2,559 million € | -21.6% |

Key figures for the brands belonging to the Brand Group Core1):

| Unit sales | Sales revenue | Operating profit | Operating return | ||||||||||||||

| 000 units/mill. | H1/24 | H1/23 | H1/24 | H1/23 | H1/24 | H1/23 | H1/24 | H1/23 | |||||||||

| Volkswagen Passenger Cars | 1,518,756 | 1,523,285 | 42,194 | 42,952 | 966 | 1,641 | 2.3% | 3.8% | |||||||||

| Škoda Auto | 547,690 | 545,461 | 13,652 | 13,748 | 1,149 | 911 | 8.4% | 6.6% | |||||||||

| SEAT/CUPRA | 344,313 | 317,395 | 7,752 | 7,411 | 406 | 371 | 5.2% | 5.0% | |||||||||

| Volkswagen Commercial Vehicles | 231,262 | 211,747 | 8,087 | 7,417 | 641 | 448 | 7.9% | 6.0% | |||||||||

SOURCE: Volkswagen Group